Stocks rise as Fed formally pauses interest rate hikes amid economic worries

- Share via

Reporting from Washington — The Federal Reserve’s pause in interest rate hikes formally began Wednesday as it expressed new concerns about the strength of the U.S. economy.

The question now is how long the pause will last amid a dearth of economic data because of the partial government shutdown, slowing U.S. and global growth, and public pressure from President Trump to keep interest rates low to stimulate the economy.

Investors appeared to believe it will be a while before the Fed hikes again, with the Dow Jones industrial average jumping about 260 points after the central bank’s announcement.

The Dow had already risen after Apple’s earnings results beat estimates and Boeing posted record revenue. The index later gave back some of its post-Fed announcement gains and closed up 435 points, or 1.8%, at 25,014.86.

Fed monetary policy officials on Wednesday unanimously voted to hold their key short-term interest rate steady at 2.25% to 2.50%. The move was widely expected after a hike of a quarter percentage point in December, the Fed’s fourth increase last year.

Banks use the benchmark federal funds rate to determine interest rates for credit cards, car loans, small-business loans and other debt.

In a statement after the two-day meeting, Fed officials said they “will be patient” as they determine the pace of future hikes. It was one of several significant changes — unusual for the Fed — in its post-meeting statement compared with the one released in December.

Fed officials downgraded economic growth to “solid” from “strong.” And a reference to an expectation of “some further gradual” rate increases was removed and replaced with a sentence stressing the patient approach “in light of global and economic financial developments and muted inflation pressures.”

The Fed hikes the rate to keep the economy from growing too quickly and causing high inflation.

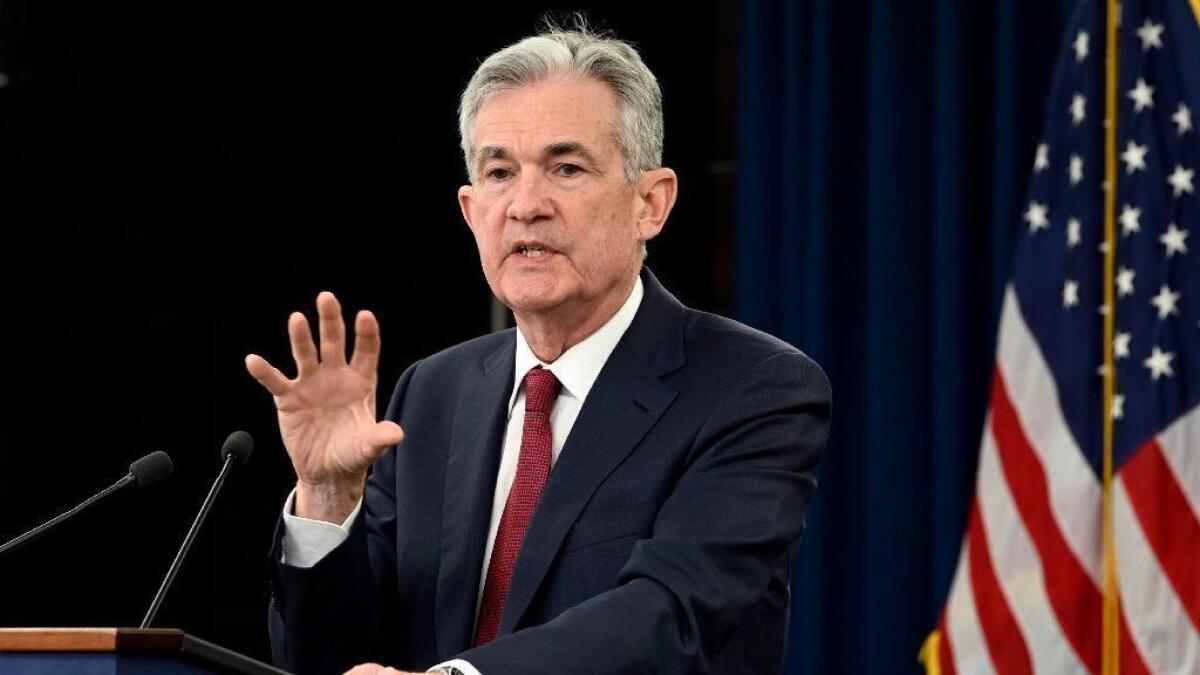

Speaking to reporters after the meeting, Fed Chairman Jerome H. Powell was mostly upbeat about economic conditions and downplayed the significance of the pause in hikes.

“The U.S. economy is in a good place, and we will continue to use our monetary policy tools to help keep it there,” he said. Given “crosscurrents” affecting the U.S. and global economies and uncertainty about the outlook, Powell said, “common-sense risk management suggests patiently awaiting greater clarity.”

Brian Coulton, chief economist at Fitch Ratings, said the Fed’s statement “reads more like a pause than a strong signal that they believe that they are [at] the end of the hiking cycle.”

Fed officials also released new guidance about its ongoing effort to reduce the trillions of dollars’ worth of bonds it purchased to stimulate the economy during and after the Great Recession by helping push down long-term interest rates.

The Fed has been gradually allowing about $50 billion in maturing securities to be run off its books each month. The amount of assets — Treasury bonds and mortgage-backed securities — on the Fed’s books ballooned to $4.5 trillion from 2008-17, before the reductions began. The amount of assets now is down to about $4.05 trillion.

Fed officials said Wednesday they would continue to use interest rate hikes as their main monetary policy tool but “would be prepared” to adjust the amount of its assets if more stimulus was needed.

The guidance signaled that Fed officials could slow the reduction of assets and even start buying new Treasury bonds and other securities if the economy slowed further. Acquisitions inject cash into the economy and push down long-term interest rates.

Powell and his colleagues signaled in December that they would slow their pace of rate hikes to just two this year. The next forecast will be released in March.

For months, Trump had been publicly criticizing Fed officials — breaking tradition with past presidents — and pushing them to stop gradually increasing the federal funds rate.

But Powell rejected the suggestion that he and his colleagues, who are legally independent from the White House, had caved to Trump’s demands.

“We’re always going to do what we think is the right thing,” he said.

“We’re never going to take political considerations into account or discuss them as part of our work,” Powell said. “We’re human, we make mistakes, but we’re not going to make mistakes of character or integrity.”

Despite the new rate forecast in December, investors had remained nervous about the Fed’s intentions until Powell said in a Jan. 4 speech that it would be “patient” moving forward as it watched to see how the economy developed.

Wednesday’s statement showed that Powell’s colleagues all agreed with that approach. But judging the state of the economy became more difficult when the government partially shut down for 35 days starting Dec. 22.

Among the agencies closed was the Commerce Department, postponing the release of important data, including reports on monthly retail sales, foreign trade and new home sales as well as fourth-quarter economic growth.

On top of that, the January jobs report due to be released by the Labor Department on Friday is likely to be skewed by the furlough of about 800,000 federal workers.

The partial shutdown, the longest in U.S. history, was temporarily ended on Friday, through Feb. 15.

Powell said Wednesday that though the shutdown would reduce total economic output, also known as gross domestic product, in the first quarter, the effect should be only temporary — as long as there wasn’t another shutdown.

“Even with a fairly long shutdown, as long as that’s the end of it and everyone gets their backpay … then the lost GDP will be regained in the second quarter,” he said.

The Commerce Department said it would start releasing some of the delayed data this week.The economy was boosted in the first half of 2018 by the Republican tax cuts that took effect last January, but growth began decelerating in the second half of the year, and the slowdown is expected to continue through 2019.

Fed officials forecast in December that annual economic growth would decline to 2.3% this year, from 3% in 2018. That mirrors a slowdown in the global economy.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.