A new generation of giant rockets is about to blast off

- Share via

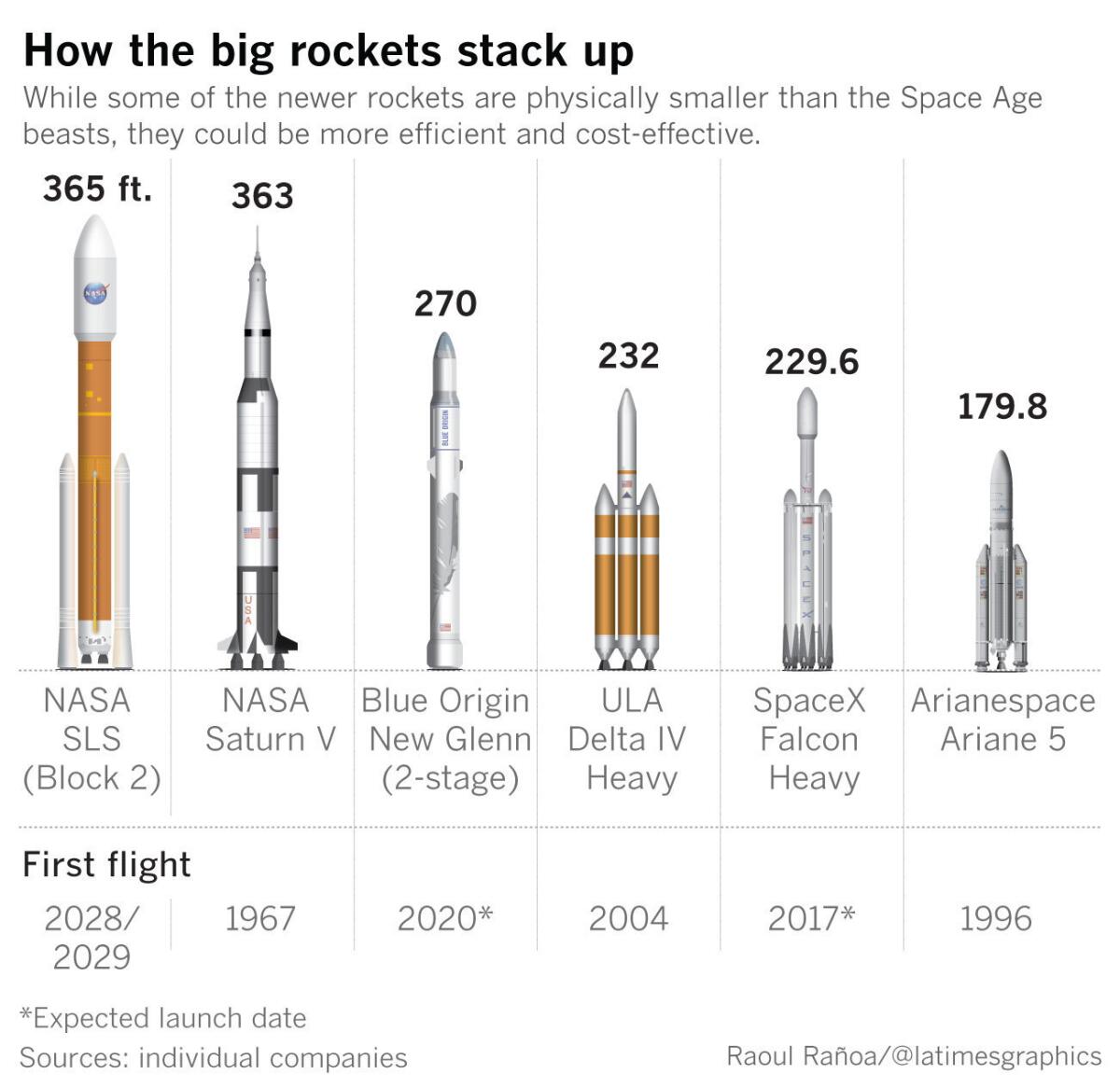

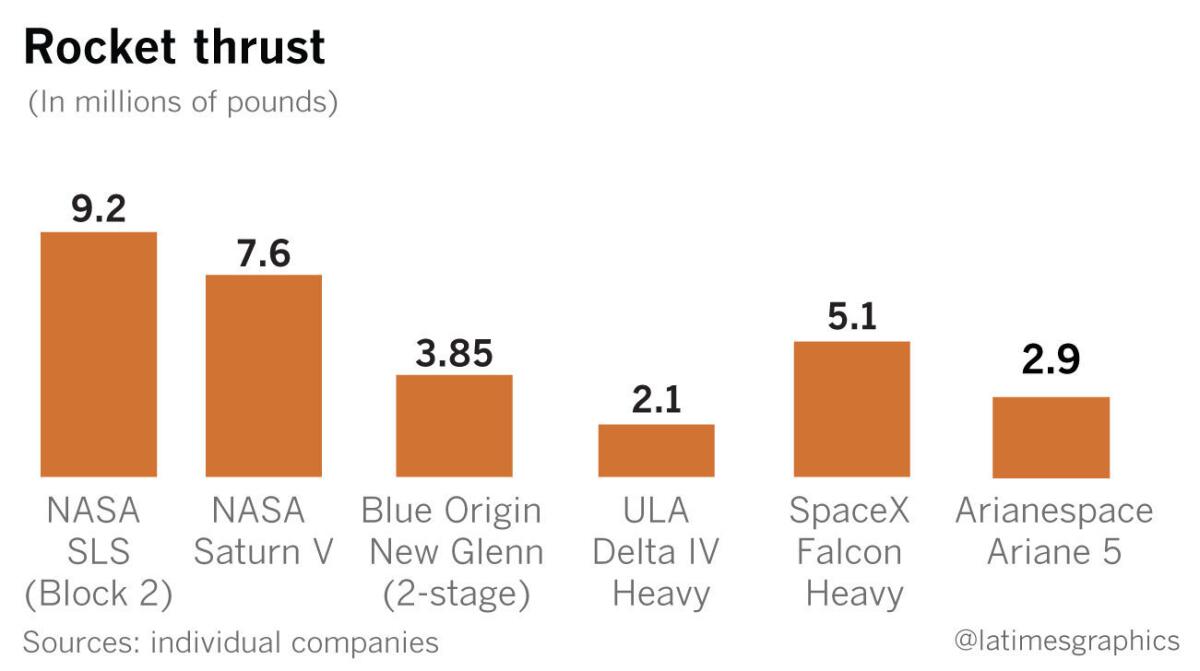

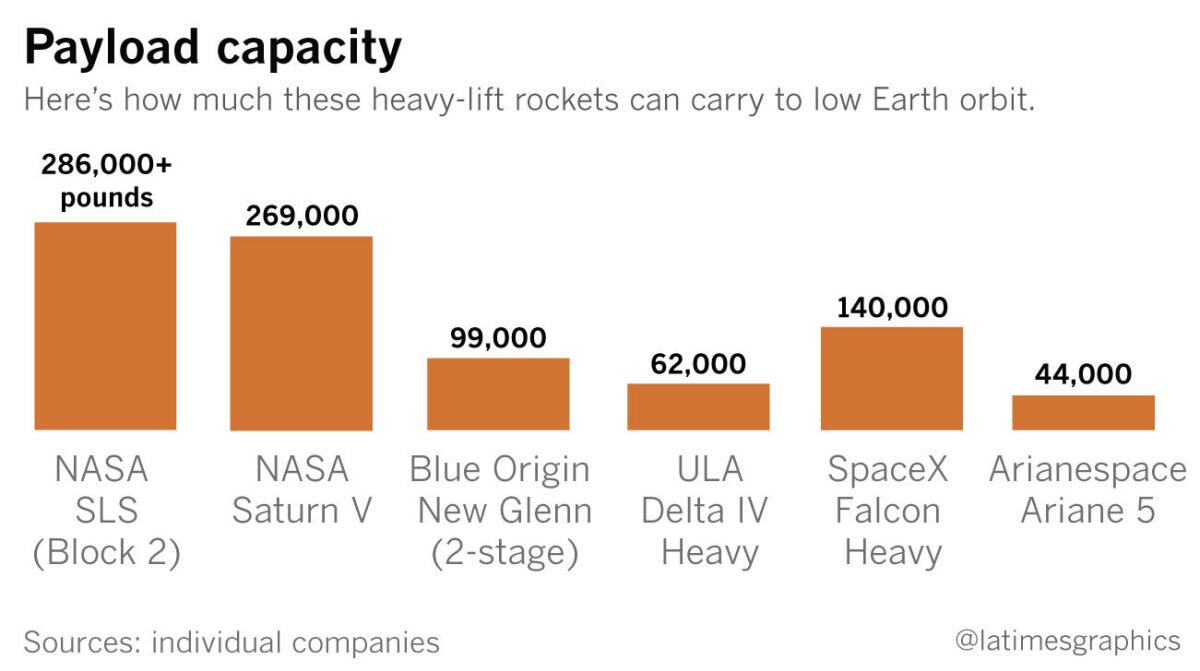

It’s been 44 years since the mighty Saturn V last thundered skyward from a launch pad at Kennedy Space Center in Florida. The towering rocket, generating enough power to lift 269,000 pounds into orbit, had been the workhorse of the Apollo moon missions.

Later this year,

But unlike the Saturn V, the Falcon Heavy will have plenty of competition.

Years in the works and the product of hundreds of millions of dollars of investments, a new generation of huge rockets will soon take to the skies. Their manufacturers range from space start-ups to aerospace giants to the space agencies of the United States, Russia and China.

Thanks to advances in fuel, materials and electronics, the new rockets, while physically smaller than some of the Space Age beasts, may be more efficient and cost-effective. They will be able to hoist massive spy satellites to a high orbit or ferry crews into deep space.

The rush of new rockets has prompted some to question whether

After years of a monopoly, the lucrative business of launching sensitive national security satellites is now competitive, which may be an incentive for the big rockets. But at the same time, the launch demand for large satellites is not expected to change.

And in the case of SpaceX, the workhorse Falcon 9 rocket — which recently completed its 10th mission of the year — has been upgraded to the point where it can handle heavier loads than originally anticipated.

Whereas SpaceX first thought that it would fly the same numbers of Falcon 9s as Falcon Heavys, that ratio is turning out to be about two to three times more Falcon 9 commercial missions. The company’s May launch of the Inmarsat-5 F4 satellite on a Falcon 9 was originally slated for a Falcon Heavy.

“There is a part of the commercial market that requires Falcon Heavy,” said Gwynne Shotwell, president of SpaceX. “It’s there, and it’s going to be consistent, but it’s much smaller than we thought.”

That hasn’t deterred rocket makers.

One analyst estimated that companies together are pouring hundreds of millions of dollars into the large rockets. SpaceX says the price of a Falcon Heavy launch will be at least $90 million, versus $62 million for its Falcon 9.

Last year, Amazon.com Inc. Chief Executive Jeff Bezos unveiled plans for a heavy-lift rocket called New Glenn to be built by his space firm, Blue Origin. The rocket, which will have two-stage and three-stage versions, was designed to launch commercial satellites and to take humans into space. Analysts have speculated that Blue Origin may also eventually want to compete in the national security launch market.

United Launch Alliance (ULA), a joint venture of

Orbital ATK Inc., a commercial aerospace firm in Dulles, Va., intends to expand its lineup with its first intermediate and heavy-lift rockets, known for now as the Next Generation Launcher (NGL).

Europe’s Arianespace already can use its Ariane 5 heavy launcher to take two large satellites into space.

While rockets may look similar on liftoff, their makers can be selective in the contracts they target.

SpaceX, for instance, has tried to compete for nearly all types of launches, but Orbital ATK seems to be focusing on the extreme ends of the market — small and large payloads, said Carissa Christensen, chief executive of consulting firm Bryce Space and Technology.

“The launch market is complicated and so specialized that all of those players could find a niche,” she said.

New fuel, old engines

The U.S. government, along with its contractors, has a long history of developing large rockets. That includes the Saturn V, the largest and most powerful rocket ever flown successfully, and ULA’s Delta IV Heavy, the most powerful rocket currently used by the Air Force to carry national security satellites to orbit.

The heavy-lift launchers of tomorrow aim to take advantage of key developments in composite materials, electronics and other technologies.

The first-stage booster of ULA’s proposed Vulcan rocket, for example, could be powered by BE-4 engines under development by Blue Origin that run on oxygen-rich staged combustion of liquefied natural gas and liquid oxygen. Those engines will also be used in Blue Origin’s own New Glenn heavy-lift rocket.

Liquefied natural gas, or methane, is cleaner than kerosene, a more conventional rocket fuel. That means it’s less likely to clog up fuel lines in the engine and makes it easier to purge and use again, said Ann Karagozian, a UCLA professor of mechanical and aerospace engineering.

Methane also self-pressurizes, which could eliminate the need for a separate tank pressurization system.

“It would be quite new and novel and different to use methane,” Karagozian said. “But … it hasn’t been used to any significant degree in this country at all,” so there’s no infrastructure in place at launch facilities.

But not all the technology is completely cutting edge. The core stage of NASA’s Space Launch System vehicle will use four RS-25 engines — relics from the space shuttle program that are being retrofitted with new controllers that are smarter and lighter than past computers.

NASA already had 14 engines that had previously flown on the space shuttle and enough material to make two new engines, said Jim Paulsen, vice president of NASA programs at Aerojet Rocketdyne, which makes the engines. Despite its age, the RS-25 remains the “most efficient booster engine,” said company spokesman Glenn Mahone. The company will perform tests on the engines to make sure that everything is running properly before being tested as a core stage.

Reusing parts after launch has changed the conversation about rocket economics, and it could be a factor in knocking down prices of the big rockets too, if there is enough demand. Both Blue Origin and SpaceX designed their first-stage boosters to be able to land after launch.

SpaceX Chief Executive Elon Musk has said the Falcon Heavy will attempt to land its two side boosters — which on its demonstration flight will be reused first stages from previous missions — as well as its center core booster in a kind of “synchronized aerial ballet.”

Shotwell said the company is currently working to see if it can bring the side boosters back to land, which would require overhauling its landing zone at Cape Canaveral. SpaceX may also need to build more droneships if the company chooses to land the side boosters at sea, she said.

Chasing spy satellites

A boom in small satellites for Internet access, commercial imaging and Earth observation has led to a surge in new rocket companies, several of them based in Southern California.

While small launchers are being developed to give these satellites a dedicated ride to space, initial deployment of these so-called constellations is likely to require launches of 10 or more satellites at a time — and heavier rockets — to start operations as soon as possible, said Marco Caceres, senior space analyst at the Teal Group.

Demand for heavy rockets will remain relatively flat over the next 10 years, at 20 to 25 launches a year, according to data from Bryce Space and Technology. However, U.S. companies are expected to win more contracts in the international launch market, said Phil Smith, senior space analyst at Bryce Space and Technology.

SpaceX’s success two years ago in challenging ULA’s monopoly on military launches may have emboldened new challengers to try to compete for the limited number of military and other national security launches.

Orbital ATK plans to compete its proposed NGL intermediate- and heavy-lift rockets in future Air Force competitions. So far, the company has passed crucial design reviews and is working toward a static fire of its four-segment heavy-lift booster in about 2022. The company expects that rocket to be operational in 2024.

Orbital ATK sees NGL as a natural progression from its smaller rockets, such as Pegasus and Antares. Antares currently delivers supplies for NASA to the International Space Station.

“We have made very incremental steps in improving our capability,” said Mark Pieczynski, vice president of business development and strategy for Orbital ATK’s flight systems group. “We’re now ready to move into the intermediate and heavy class.”

Orbital ATK and the Air Force together are investing more than $200 million to develop the launch system.

SpaceX also plans to seek certification from the Air Force for its Falcon Heavy for national security launches. After a demonstration flight later this year, the Falcon Heavy’s first customer launch will be for the Air Force.

SpaceX’s entry into the military launch market also may have encouraged ULA to develop its next generation rocket, Vulcan, to compete, Caceres said. The Boeing-Lockheed venture has said Vulcan will allow for “more affordable” launches.

“I think ULA felt vulnerable and they had to move into a new direction,” he said.

The mission to Mars

Deep space exploration is one mission that can’t be tackled without the power that bigger rockets provide.

NASA has embarked on a likely decades-long, multibillion-dollar program to develop the SLS rocket, the

The smallest version of the rocket is set to make its first, uncrewed flight in 2019 when it journeys to a distant retrograde orbit around the moon. The larger, 365-foot version of the rocket is expected to make its first flight in 2028 or 2029.

The ultimate goal is to reach deep space, which includes Mars, said Garry Lyles, chief engineer for SLS.

“It’s not designed to do one mission,” he said. “It’s designed to do any deep space mission.”

NASA’s SLS has utilized new technological advancements and built on lessons learned from the space shuttle program, such as incorporating lighter, cheaper composite materials, pioneering new welding technology and utilizing 3-D printing to manufacture engine parts, Lyles said.

But the program has also faced cost and technical challenges that ultimately contributed to a delay in the first flight of the rocket and capsule.

A NASA Office of Inspector General report released in April cited estimates that sending a crew to Mars could cost more than $400 billion by the time of a second mission to the Red Planet in the 2040s.

The report said NASA needs to develop a more detailed mission plan and schedule, and should establish rough cost estimates to make clear the “magnitude of sustained investment required to make human exploration of Mars a reality by the late 2030s or 2040s.”

Congress may balk at making that investment if SpaceX succeeds with the Falcon Heavy, said Caceres of the Teal Group.

“There’s going to be increasing pressure by Congress to get NASA to figure out why it needs the SLS,” he said. “It’s a hugely expensive program.”

Nonetheless, Lyles said he was supportive of private industry’s entry into the big-rocket business.

“As much as we can inspire other launch vehicle companies and industry to enter that venture of space, I think that’s our job,” he said. “I’m really hoping and rooting for the commercial companies to do what they’re doing.”

Twitter: @smasunaga

ALSO

SpaceX will launch secretive X-37B spaceplane's next mission

Where do SpaceX and other aerospace companies find engineers? On the race track

SpaceX launches Falcon 9 rocket carrying 10 communications satellites

The United Arab Emirates launches a plan to colonize Mars by 2117

These 12 Americans had the right stuff to be picked for NASA's new class of astronaut trainees

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.