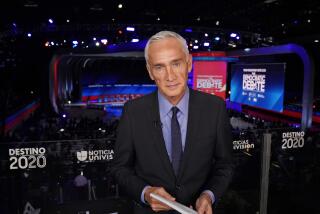

Debt-heavy Univision survives punches for now

When Spanish-language broadcasting giant Univision Communications Inc. was sold for $13.7 billion three years ago, the highly leveraged deal was, in the words of one veteran banker, “priced for perfection.”

Given the $10 billion in debt the buyers were assuming, the slightest hiccup in the company’s financial performance would have a cascading, negative effect.

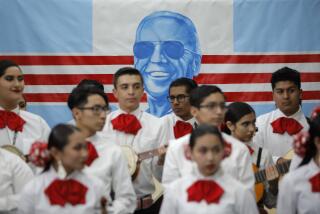

The buyers, a consortium of investors including entertainment mogul Haim Saban, were counting on several factors to justify the steep purchase price: The nation’s exploding Latino population and the popularity of Spanish-language programming, coupled with the promise of robust advertising growth. They expected to hold the assets for a few years and then sell them at a tidy profit.

One thing the buyers have learned: It’s not a perfect world.

In the two years since the buyout, the economy has collapsed, dragging down advertising to media companies. Adding to the economic distress, Univision, owner of KMEX-TV Channel 34 in Los Angeles, has been mired in a costly legal battle with its primary programming partner.

The big payday for Univision’s owners, which include a group of well-heeled private equity firms, seems further away and far less certain. So instead of riding a high wave to easy profits, Univision executives have been working furiously to dig Univision out of its hole.

During the last year, the broadcaster has written down assets by $5.3 billion, and some industry insiders now believe the nation’s largest Spanish-language media company is worth closer to $9 billion -- slightly less than what it owes.

“This is about survival,” said Sean Mathis, a partner at New Centurion Capital Partners, a New York investment bank that specializes in restructurings, but is not involved with Univision. “They have to service all of this debt that they put on the company, and they are not generating the cash flow they need.”

In recent months, Univision has been busy putting out fires on multiple fronts to shore up its finances and to protect its programming pipeline.

In January, it settled a nagging lawsuit brought by its longtime programming partner, Grupo Televisa of Mexico, which had threatened to strip Univision of its most popular and profitable shows. The resolution guaranteed Univision the right to broadcast Televisa’s hugely popular soap operas, including “Cuidado con el Angel,” through 2017.

Two weeks ago, Univision bought itself breathing room by refinancing $500 million in debt, pushing back the due date by three years to 2014. The extension means that Univision no longer has to worry about burning through its cash within the next two years.

And during the last few months, Univision achieved one of its highest priorities -- getting cable and satellite TV operators to pay the company to carry its programming. The agreements with Time Warner Cable Inc., DirecTV Corp., AT&T; Inc. and others should bring Univision $175 million this year, and as much as $350 million annually by 2014.

The cable subscriber fees helps Univision diversify its revenue and, for now, make up for the decline in ad revenue.

Univision’s chief financial officer, Andrew Hobson, said the company’s actions during the last six months had put it on a stronger footing and should allow it to weather other economic storms.

“Our balance sheet is now bulletproof for even the most draconian scenarios,” Hobson said. “We don’t feel that we have covenant risks or liquidity risks for at least another five years.”

Still, credit rating agencies worry that Univision could default on its loans that total $9.7 billion.

“This clears the runway a little bit for them, but we still have concerns about their liquidity and their ability to make their debt amortization payments,” said Standard & Poor’s credit analyst Michael Altberg, who acknowledged that Univision had bolstered its position. “Before their credit amendment, they didn’t have that much of a cushion.”

Barclays Capital debt analyst Andrew Finkelstein said Univision executives did “exactly what they needed to do for now.”

But Univision’s challenge in the next few years, he said, will be to increase revenue -- a difficult task during an economic recession.

“So now it’s clear sailing for them until 2014, which should give them enough time to grow their business and cash flows and make their balance sheet work,” Finkelstein said. Nonetheless, he said Univision must “show growth in their business” to support its capital structure.

Univision’s predicament is not all that unusual for a company sold in a leveraged buyout at the top of the market.

In 2006, Univision’s then-controlling shareholder, billionaire A. Jerrold Perenchio, orchestrated a bidding war for the company. The Spanish-language broadcaster had been showing dramatic growth, along with the Latino population. Univision’s upside seemed unlimited.

On one side of the auction was Televisa and investor companies, including Cascade Investment, Microsoft Corp. founder Bill Gates’ asset management firm. On the other was Saban, who has made a fortune owning the Mighty Morphin Power Rangers and, later, through selling a stake in the Fox Family cable channel to Walt Disney Co. He was joined by private equity firms Providence Equity Partners, Madison Dearborn Partners, Thomas H. Lee Partners and Texas Pacific Group.

To claim the prize, the Saban group agreed to pony up $12.3 billion as well as assume $1.4 billion in existing debt.

The four private equity firms each contributed about $900 million, and Saban chipped in $300 million.

Bank loans made up the remaining $10 billion needed to take the company private.

Saban, now chairman of Univision, declined to comment for this article.

The buyers figured they could drive up the value of Univision for a quick sale, within five years, by improving areas of the company that they felt had been insufficiently mined: requiring cable and satellite TV operators to pay for carriage of Univision’s two broadcast networks, and raising the prices charged to advertisers for commercial time.

Then the recession hit and ad rates fell.

“Univision had been raising its rates for many years,” said Hector Orci, co-chairman of Los Angeles advertising firm La Agencia de Orci & Asociados. “They thought they would continue with business as usual, but now business as usual has become minus 5%.”

So instead of taking in more ad revenue, Univision’s owners saw the collapse of the auto industry, one of television’s biggest advertisers.

Retailers and banks, also major buyers of radio and TV commercials, sputtered too. In 2009’s first quarter, Univision’s revenue skidded 12% to $410.3 million.

“We think we’ve hit bottom there. Now we see a more stable environment,” said Joe Uva, Univision’s chief executive. “As the economy starts to improve, we are poised to take advantage of that.”

But media veterans speculate that Univision would be hard pressed to refinance its loans again -- not to mention selling the company -- if it waits until 2014, when the bulk of the debt must be repaid.

By that time, the broadcaster will have only three years remaining on its programming agreement with Televisa, which expires at the end of 2017.

Few buyers would be willing to pay a premium for a company that could suddenly be without its most important source of programming.

And without Televisa’s shows, Univision’s value is in doubt.

“Their strategic plan has to include what to do after 2017, and that means developing more original programming,” Orci said. “But that’s going to be a huge investment. There are a hundred failures on the way to find that one big hit. But they have to figure that out in the next couple of years, or they will be in trouble.”

--

--

(BEGIN TEXT OF INFOBOX)

A brief look at Univision’s recent history

February 2006: A. Jerrold Perenchio and Univision’s board of directors put the company on the block, hoping to fetch at least $13 billion.

Spring 2006: Mexico’s largest media company, Grupo Televisa, and entertainment mogul Haim Saban and four private equity firms work to prepare opposing offers.

June 2006: Saban Capital Group, Providence Equity Partners, Madison Dearborn Partners, Thomas H. Lee Partners and Texas Pacific Group emerge as the highest bidders, besting Televisa by agreeing to pay $12.3 billion and assume $1.4 billion in debt.

March 2007: The consortium takes ownership of Univision, with each of the firms contributing about $900 million in equity and Saban contributing $300 million.

February 2008: Univision sells its music labels Fonovisa Records and Disa Records to Vivendi’s Universal Music Group for about $112 million -- less than it had hoped.

January 2009: Federal trial begins in Los Angeles to determine whether Televisa had the right to terminate its programming contract with Univision. Case is settled; Televisa agrees to continue to provide shows to Univision.

February 2009: Advertising downturn forces Univision to lay off 6% of its workforce.

Spring 2009: Univision negotiates payments from cable and satellite TV companies. The deals should add $175 million in revenue to Univision this year and as much as $350 million annually by 2014.

June 2009: Univision refinances $500 million in debt due in 2011, extending the date of maturity to 2014.

Source: Times research

--

Univision: a quick rundown

Name: Univision Communications Inc.

Headquarters: New York

Number of employees: 4,200

Debt: $9.7 billion

Annual revenue: $1.97 billion (estimated for 2009)

Cash flow: $786 million

Key properties: Two broadcast networks, Univision and TeleFutura; cable channel Galavision; 20 television stations; 67 radio stations; and an Internet site. The Spanish-language broadcaster also owns a joint venture called TuTV, which provides television channels to cable and satellite TV companies.

Source: Times research

More to Read

The biggest entertainment stories

Get our big stories about Hollywood, film, television, music, arts, culture and more right in your inbox as soon as they publish.

You may occasionally receive promotional content from the Los Angeles Times.