California has lost more than half a million jobs to China — more than any other state, report says

- Share via

California has lost more jobs to China than any other state since 2001, fueled by Silicon Valley outsourcing and the continued shrinking of Southern California’s apparel industry, according to a report released Tuesday by a Washington, D.C., think tank.

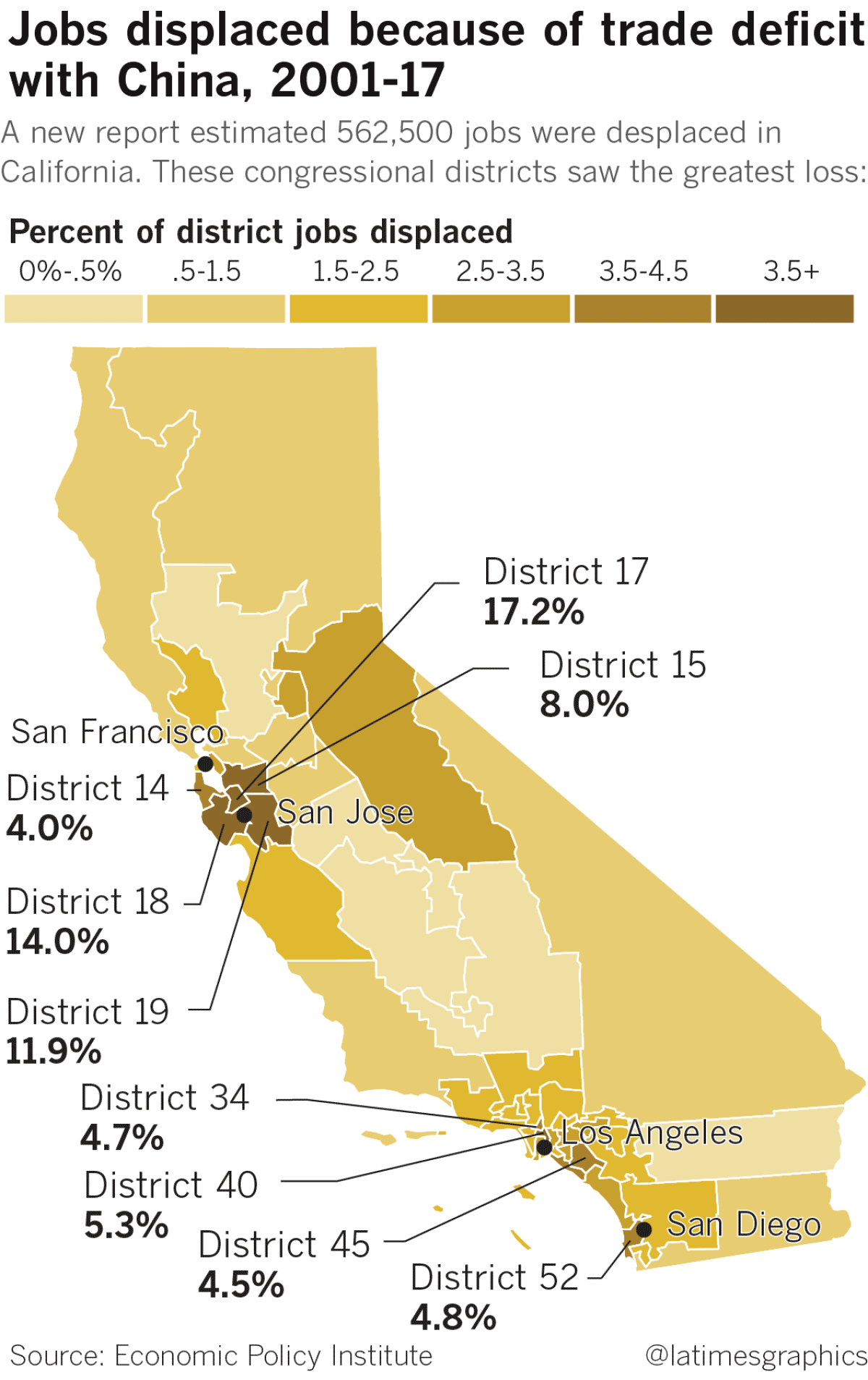

Some 562,500 jobs were displaced in the Golden State, the equivalent of a 3.34% share of California’s total employment of 16.8 million jobs in 2017, the Economic Policy Institute concluded.

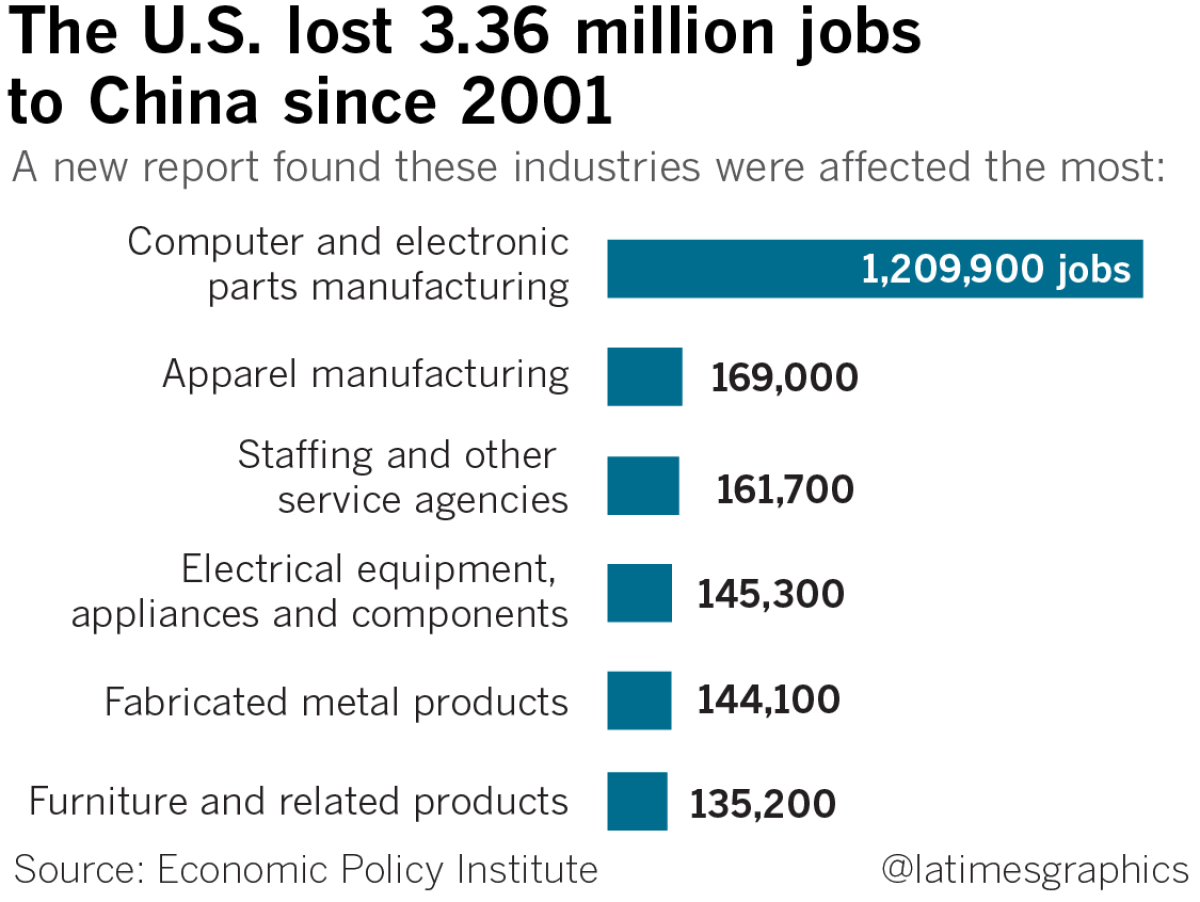

In the U.S. overall, 3.4 million manufacturing jobs were lost since China entered the World Trade Organization in 2001, according to the report, which reached its conclusions by subtracting job opportunities lost to imports from those gained by exports.

“The U.S.-China trade relationship needs to undergo a fundamental change,” according to the institute, which is affiliated with labor-union critics of unfettered globalization. “Addressing unfair trade, weak labor, and environmental standards in China, and ending currency manipulation and misalignment, should be our top trade and economic priorities.”

The report, titled “The China Toll Deepens,” comes as President Trump’s trade war with China continues to escalate.

He has accused the Asian nation of unfair trade practices and slapped tariffs on $250 billion in Chinese goods, roughly half of what China sells to the U.S. each year. He also has threatened to launch a third round of tariffs on $267 billion in Chinese imports if a new trade deal is not reached.

The report describes how the composition of Chinese imports has fundamentally changed.

Most striking was the huge displacement in computer and electronic parts employment, according to the report, which found a net of 1,209,900 U.S. jobs eliminated, 36% of the total losses in manufacturing. In California, the Silicon Valley-based industry accounted for 56% of all jobs displaced by China trade.

“Since it entered the WTO in 2001, China has moved rapidly upscale, from low-tech, low-skilled, labor-intensive industries such as apparel, footwear, and basic electronics to more capital- and skills-intensive industries such as computers, electrical machinery, and motor vehicle parts,” it noted.

The result: a loss of high-skill, high-wage jobs, stagnating wages and widening U.S. inequality, the report asserted, adding that many of the industries absorbing displaced workers are in sectors such as retail and home healthcare, which pay less with fewer benefits.

Economist Robert Scott, coauthor of the report, said that his analysis should not be read as bolstering the case for Trump’s policies, which he said are “at best ineffectual and likely to make the trade deficit worse, not better.”

Republican-supported tax cuts and spending increases, Scott added, will turbocharge the U.S. budget deficit with “a sugar-high that pushes up interest rates, attracting capital from abroad and strengthening the dollar. The rising dollar will make Chinese imports cheaper.”

“Hitting China with 25% tariffs is not the solution,” he said.

The report notes that the U.S. goods trade deficit with China grew from $83 billion in 2001 to $375 billion in 2017. Scott said that since 2001 “virtually all of the growth in the U.S.’ global deficit of $807 billion last year is due to the growth of trade deficits with China.”

China’s exports to the U.S. in 2017 were nearly four times greater than U.S. exports to China.

However, Los Angeles economist Sung Won Sohn, an expert on Pacific Rim trade, said that even as much of California’s computer and electronics hardware manufacturing moved to Asia, “a lot of software jobs were created in Silicon Valley, and a lot of the hardware we import from China and Korea uses software manufactured in the U.S.”

Sohn cautioned that the numbers in the institute report may be “overstated,” but he added, “the conclusions are correct: We are losing jobs as a result of the huge trade deficit, and I blame much of it on unfair trade practices by China.”

The 2001-17 China trade deficit has led to job displacement in every state and congressional district, the report noted. After California, the states with the highest losses were Texas (314,000) New York (183,500), Illinois (148,200) and Pennsylvania (136,100).

Of the top 10 congressional districts with the highest share of job displacement, five were in California and the top three were in Silicon Valley, including the 17th Congressional District. That district — ranging across Sunnyvale, Cupertino, Santa Clara, Fremont, Newark, North San Jose and Milpitas — lost 59,500 jobs, or 17.2% of its overall employment, the report asserted.

In Southern California, San Diego County’s 52nd Congressional District lost 16,900 jobs, 4.8% of its total, and Orange County’s 45th Congressional District lost 16,100 jobs, 4.5% of its total, according to the report.

The researchers also found that between 2001 and 2011 the growing trade deficits with China reduced the incomes of “directly impacted” U.S. workers by $37 billion per year. And in 2011 alone, competition with imports from China and other low wage-countries reduced the wages of all U.S. non-college graduates by $180 billion per year.

“Most of that income was redistributed to corporations in higher profits, and to workers with college degrees in the very top of the income distribution in higher wages,” the report said.

The institute’s research, which has tracked China trade for two decades, was sharply disputed by the US-China Business Council, a trade association for American corporations doing business in China.

The group acknowledged that “some workers … do lose their jobs to lower-cost imports,” but characterized the study as “based on the faulty assumption that every product imported from China would have been made in the U.S. otherwise.

“Much of what we import from China replaces imports from other countries, not products we make in the U.S. today,” the group said in a statement. “Think about the television in your home. The label on the back probably says ‘Made in China.’ Fifteen years ago the label likely would have said ‘Made in Japan’ — but it was still an import.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.