U.S. says $9-billion BNP Paribas fine is warning to bank shareholders

- Share via

With a record $9-billion fine against BNP Paribas, one of the world’s largest banks, the Justice Department aimed Monday to send a clear message to bank shareholders everywhere.

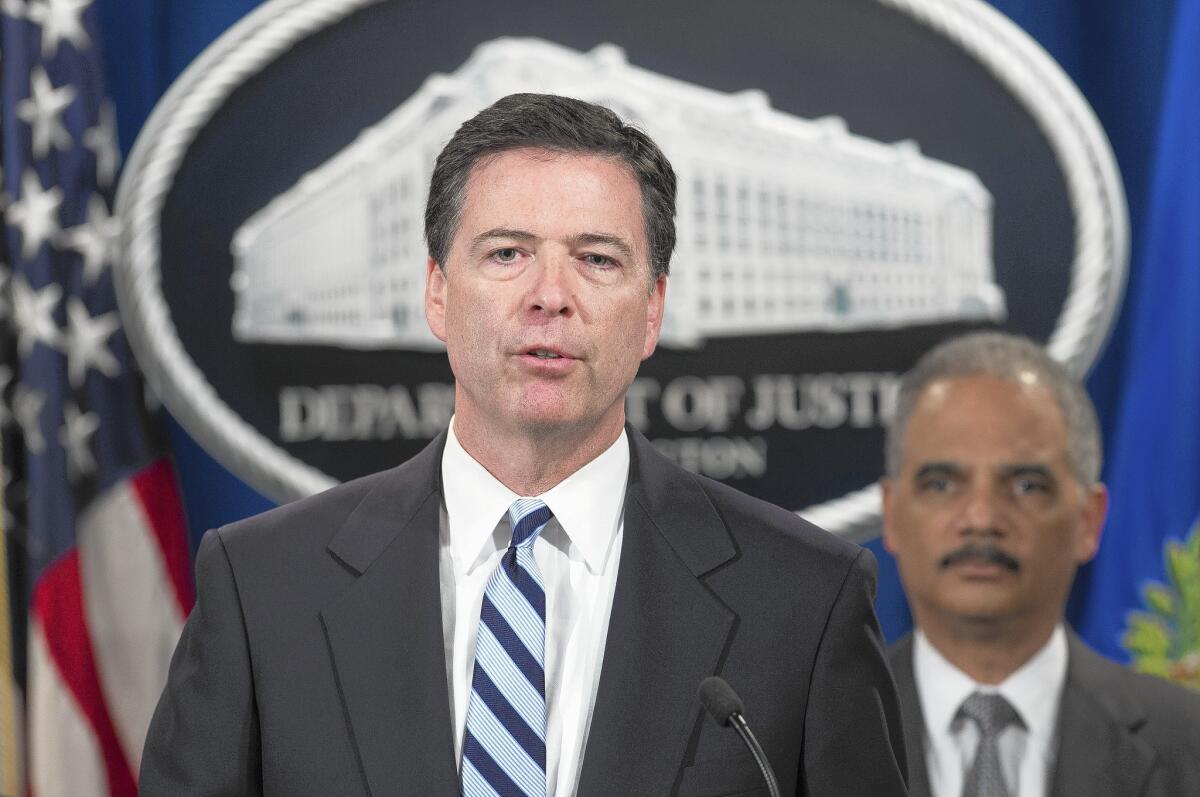

“The $9 billion that’s walking out the door today is your money,” FBI Director James B. Comey said at a Monday news conference. Until shareholders hold corporate chiefs accountable for following the law, “the money will keep walking out the door.”

The French financial giant also pleaded guilty to criminal charges of defying U.S. economic sanctions against Sudan, Iran and Cuba. The settlement is the largest ever in a case involving blacklisted nations and the largest in a criminal case involving a bank, officials said.

The conviction contrasts sharply with a series of large settlements with U.S. banks linked to the financial crisis, as well as with foreign banks such as Britain’s HSBC, which was accused of widespread money-laundering violations. With no criminal components, those cases have been attacked as comparative “wrist slaps” by Sen. Elizabeth Warren (D-Mass.), among other critics.

Comey was flanked by several top Justice Department officials, including U.S. Atty. Gen. Eric H. Holder Jr., who said officials expect to make “major announcements” soon about additional banking investigations, including domestic cases.

“We are not [solely] targeting banks outside our shores,” Holder said.

BNP Paribas has $2.5 trillion in assets, more than any U.S. bank. It was accused of falsifying records from 2004 through 2012 to conceal its funneling of billions of dollars from nations deemed security threats through its U.S. operations. (Its San Francisco subsidiary, Bank of the West, was not accused of wrongdoing, officials said.)

The total amount paid by BNP Paribas to federal and state authorities, including financial penalties, is $8.97 billion — $8.83 billion in forfeiture and a $140-million fine. None of the payments would be tax deductible in the U.S., according to the Justice Department.

The bank was put on notice as early as 2007 that the U.S. regarded its practices as illegal but continued to pursue them, Assistant Atty. Gen. Leslie R. Caldwell said.

The bank “deliberately disregarded U.S. law, of which it was well aware, and placed its financial network at the services of rogue nations, all to improve its bottom line,” Caldwell said. “Remarkably, [BNP Paribas] continued to engage in this criminal conduct even after being told by its own lawyers that what it was doing was illegal.”

In a statement, the Paris financial firm said it regrets its misconduct and has “designed new robust compliance and control procedures.”

“The failures that have come to light in the course of this investigation run contrary to the principles on which BNP Paribas has always sought to operate,” Chief Executive Jean-Laurent Bonnafe said in a statement.

As part of its settlement, the bank was required by New York state banking regulators to clean house of those involved, including Georges Chodron de Courcel, its chief operating officer, who has announced his departure.

What Holder called the bank’s “complex and pervasive scheme” involved structuring payments in needlessly complicated ways and concealing the identities of blacklisted individuals and corporations — a “tour de fraud” in the words of Preet Bharara, the U.S. attorney for Manhattan.

Critics said that even with the criminal plea, the government had gone too easy on BNP Paribas.

“Business continues apace and at profit at one of the world’s largest banks,” said Bartlett Naylor, a financial policy advocate at the consumer group Public Citizen.

Jaret Seiberg, a senior Washington policy analyst for Guggenheim Partners, said he remains worried that a guilty plea might cause severe damage to a large U.S. bank, with clients withdrawing funds and turning elsewhere for services.

Seiberg added that top government officials also harbor such concerns and will be watching carefully to see how the stock market and customers respond to BNP Paribas’ guilty plea. A recent guilty plea by Credit Suisse, on charges of helping Americans evade taxes, produced little effect on clients and the market, he said.

“This is a much bigger case with a far larger monetary penalty,” Seiberg said. “Our view remains that the Justice Department will take a lack of reaction by investors and customers as a green light to pursue criminal charges against a domestic bank, so it can say definitively that no bank is too big to jail.”

Puzzanghera reported from Washington and Reckard from Los Angeles.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.