FBI Arrests Former Enron Energy Trader

The FBI arrested former Enron Corp. trader John M. Forney at his Ohio office Tuesday, saying he was a key architect of the electricity-trading schemes blamed for worsening California’s energy crisis in 2000 and 2001.

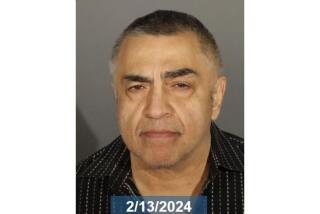

Forney, 41, was charged with a single count each of wire fraud and conspiracy. He is the third Enron trader accused by the Justice Department of criminal manipulation of Western energy markets but the first who did not reach a plea agreement -- leading to Tuesday’s arrest.

The criminal complaint unsealed Tuesday paints Forney as the draftsman behind many of the Enron trading strategies, with names such as Ricochet and Death Star, which also was dubbed Forney’s Perpetual Loop.

In one version of that scheme, Enron would promise to send power in the opposite direction of an electron traffic jam -- collecting payments from the state grid operator for relieving congestion, according to the complaint. But the power was scheduled to be sent out over a “loop” that began and ended at the same point, the complaint said, so that Enron never had to deliver the electricity it promised -- and state officials were none the wiser.

The complaint indicates that Forney played a greater role in creating and executing some of the questionable trading strategies than did his boss, Timothy N. Belden, who pleaded guilty to wire fraud conspiracy in October and has been cooperating with the federal investigation. In another plea agreement, reached in February, former Enron trader Jeffrey S. Richter pleaded guilty to wire fraud and lying to the FBI and prosecutors.

Forney’s lawyer said the energy trader would fight the charges.

“These charges are utterly without merit,” said Brian Murphy, a Columbus, Ohio, attorney representing Forney. “John looks forward to getting his day in court before a jury.”

Forney for months had been trying to work out an agreement with prosecutors, but that attempt was cut short Tuesday morning. FBI agents arrested Forney in downtown Columbus at a satellite office of American Electric Power Co., above a Mongolian barbecue restaurant, where he worked procuring coal for the company’s power plants.

Forney appeared before a federal magistrate at a detainment hearing and was released on a $40,000 bond secured by his home in Upper Arlington, Ohio. His arraignment has not been scheduled, and Forney was not required to enter a plea Tuesday.

The arrest of Forney drew the attention of Gov. Gray Davis, who used the occasion to press California’s pending demand before the Federal Energy Regulatory Commission for nearly $9 billion in refunds for alleged electricity overcharges during the energy crisis.

“It’s time that someone from Enron paid big time. I said a couple of years ago someone ought to go to jail for this deception, and it looks like that day is close,” Davis said in a statement.

“Having said that, my overriding goal, and most important goal, is to get $9 billion back for the consumers of this state who were grossly overcharged for electricity in 2000 and 2001.”

Forney “was the architect of several of the illegal trading strategies employed by Enron in order to manipulate California’s energy market,” according to a joint statement by Kevin V. Ryan, U.S. attorney for the Northern District of California; Mark Mershon, special agent in charge of the San Francisco office of the FBI; and Leslie Caldwell, director of the Justice Department’s Enron task force.

Ryan said the charges against Forney showed “our investigation is active and continuing and remains one of this office’s and the Department of Justice’s top priorities.”

But consumer lawyer Michael Aguirre of San Diego, who has filed two lawsuits against generators and traders seeking at least $41 million because of their California activities, complained that the year-old investigation does not appear to be targeting top executives at Enron or other energy companies.

“They’re losing credibility really fast. They may find the weapons of mass destruction before they prosecute Ken Lay,” Aguirre said, referring to Enron’s former chairman.

The complaint, filed Friday under seal in U.S. District Court in San Francisco, said Forney headed the “real-time” trading desk on Enron’s trading floor in Portland, Ore., which created and implemented many of the company’s schemes.

When Forney took over the round-the-clock trading desk in June 1999, it was producing “paltry revenues” selling power to a last-minute market run by the California Independent System Operator to correct supply imbalances, according to the complaint, which took the form of an affidavit filed by FBI agent Steven C. Coffin.

During Forney’s tenure, which ended in December 2000 when he transferred to Enron’s Houston offices, profit improved, the complaint said, referring to a conversation between Forney and an unidentified source who worked for him.

“Forney attributed the windfall to a scheme called Death Star, in which the real-time traders scheduled power to flow in a loop,” the complaint said.

Death Star was designed to garner fees for relieving congestion on state electricity wires. But Enron would schedule the power in a loop that began and ended in the same spot so that the firm would not have to add any power to the grid to relieve congestion, prosecutors say.

Forney also favored the Ricochet strategy, in which electricity was exported to avoid a California price cap and parked with an out-of-state generator, the complaint said. The scheme called for Enron to repurchase the power at the last minute and sell it back into California energy markets as out-of-state power.

The complaint said Forney also was involved in another technique to collect congestion payments by scheduling energy to a transmission hub that was out of service. Enron would be paid for agreeing to cancel a transmission that never could have been sent in the first place.

In addition, Forney’s traders would promise Cal-ISO a certain type of electricity known as “firm” energy, which is more reliable because it is guaranteed by another generation source if the primary source becomes unavailable, the complaint said. In reality, the complaint said, the energy would be “non-firm,” with no backup generation arranged. Cal-ISO complained that this threatened system reliability.

Enron is under new management after its 2001 bankruptcy filing and has sold its energy-trading business.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.