Up, Up, and Away

Conventional wisdom holds that, sooner or later, the stock market will crash. For more than 200 years in the United States, economic downturns have occurred at least once every 20 years and, if this pattern holds, we are just about due for another one. In years past, the stock market was not intimately connected to the overall economy. Today, however, corporate profits are rising, and more companies are publicly traded than at any time in the past. That means that the overall expansion of the economy is more closely tied to stocks than ever before, which in turn means that to an unprecedented degree, as goes the economy so go stocks.

People are forever looking at the history of economic booms and busts and then predicting that the market is bound to crash. âBut history can . . . become a tyranny,â James K. Glassman and Kevin A. Hassett write in âDow 36,000.â âJust because something has happened in the past doesnât mean it will keep happening in the future.â In the prison of old concepts, there is a substantial risk that genuine change will go unnoticed. People are so convinced that capitalism is cyclical that they may fail to recognize that we may be undergoing a shift that occurs only every few hundred years.

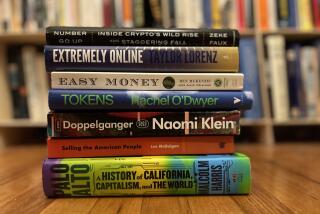

In the face of the rather incredible stock market boom of recent years, there is a slew of new books that attempt to prognosticate whether the rapid growth will continue. The most notable of these is Glassman and Hassettâs, which argues that the value of the current market will rise fourfold within five years. When they began writing the book, the Dow was at 9,000. If the current valuation of the market should be four times what it is, then the Dow should rise to 36,000 soon. Hence the bookâs title. However, when the market reaches that level, the authors contend, it will level off, and though there will still be profits to be had, dramatic gains will be rare.

The authors base their belief that the market is undervalued on a novel and controversial calculation of a stockâs perfect price, what they call PRP, or perfectly reasonable price. Described in the bookâs first half, the PRP is derived from a companyâs dividends and from the growth rate of its dividends, and it is from their debatable calculation of the PRP that the authors conclude that the Dow Jones average is far lower than it should be.

The traditional view is that the profitablity is offset by their riskiness. According to the authors, that is no longer true. With the Internet and the availability of more information, people have come to believe that stocks are at least as safe and far more lucrative than bonds or other ilow-risk nvestments. They are apt to wait out ebbs and flows, such as the recent sharp decline of IBMâs stock price, as normal and natural. The PRP takes into account the relative low risk of stocks and thereby factors out what the authors call âthe risk premiumâ that is usually tacked on when assessing how much a stock is worth. If, as the authors contend, stocks are as safe as bonds, then they ought to be priced like bonds, and in order for that to happen, the price-earnings ratio of stocks (widely known as the P/E ratio and familiar to most casual investors) would have to quadruple and, along with it, the Dow Jones average.

âDow 36,000â evolved from an op-ed article in the Wall Street Journal and a cover story for the Atlantic Monthly. Perhaps as a result of its evolution, the argument is simple, plainly stated and illustrated in a series of short, pithily written case studies. After summing up their thesis, the authors affix a second part to the book called âIn Practice.â Here they provide a map for the investor who hopes to profit from the Dow 36,000 theory. There are sections on stocks that the authors like (surprise, Microsoft is one), on money managers the authors admire (these include Jeff Vinik, the manager of the largest stock fund, Fidelity Magellan), as well as specialized or âboutiqueâ fund managers (such as David Alger, who manages a highly profitable aggressive growth fund) and on brokers they trust.

Though the âWhoâs Whoâ component is enjoyably gossipy, this half of the book is seriously flawed. Having developed a maverick theory of stock valuation in the first section, the authors suddenly switch gears and start explaining what a mutual fund is, what you should ask a broker (âWhat are your views on the market?â), how to allocate assets and why stocks are âfun.â The language and approach eerily resemble one of the âStocks for Dummiesâ books that have become so popular of late.

In the context of the first part, however, this approach makes no sense. Anyone who can follow the authorsâ argument about the PRP and the relative valuations of stocks and bonds doesnât need a primer on how to allocate assets. No one who could understand the calculations about P/E ratios, dividend growth and bond yields needs to be told in training-wheel language what they should ask a broker.

*

The Dow 36,000 theory has come under fire from economists who challenge the authorsâ figures and their logic. That is to be expected. But like any who try to chart future trends, their argument rests not on economic theory so much as on a world view derived from the present. Anyone can find facts and figures to support almost any contention. The test, then, should be coherence and, on this score, the book has one substantial weakness. Whatever the authors say about the perfect stock price, they barely address the link between the rise in stock prices and overall growth rates. If the economy continues to expand, then the Dow may well climb into the stratosphere. But if corporate profits start to shrink, then whether stocks are undervalued or not, their price will drop as investors liquidate equities to augment their stagnant incomes. The key to which way the Dow goes, therefore, may have very little to do with complicated formulas or perfect prices and everything to do with whether the economy is growing or not.

Of course, the beauty of prognostication is that the truth will be clear only in hindsight. In this thin and sometimes cloying book, Glassman and Hassett offer a vision of the future that breaks sharply with the contours of the past. The weight of conventional wisdom is against them, but we would be foolish not to consider that they might be right.

More to Read

Sign up for our Book Club newsletter

Get the latest news, events and more from the Los Angeles Times Book Club, and help us get L.A. reading and talking.

You may occasionally receive promotional content from the Los Angeles Times.