New Figures Raise Roof on Home Sales in O.C.

Sales of Orange County homes rose nearly 60% in April from the same time last year, the second-strongest single month for housing sales in the last five years, according to figures released Monday.

Increasing consumer confidence, low mortgage rates and a sense that housing prices have begun to stabilize and even increase slightly are driving the sales boom, analysts said.

âWeâre cookinâ now,â said John Karevoll, analyst with DataQuick Information Systems, the La Jolla-based real estate data firm that released the figures, which are based on closed escrows. âThis housing market continues to strengthen.â

In another positive sign, median home prices jumped $5,000 in one month, to $192,000 from Marchâs price of $187,000. However, when compared to April a year ago, the price fell 1.5%, pushed by a continuing drop in condominium prices.

After falling nearly 19% in Orange County during the downturn of the last five years, home values for resale homes in Orange County are finally starting to stabilize and increase in some areas.

A decrease in the number of new homes on the market coupled with the recent boost in housing sales is helping to drive up prices, analysts said.

A total of 3,411 homes sold during April, up 59.2% from the previous April. More homes have been sold in only one other month in the last five years--3,632 homes in June 1994.

âApril was a splendid month,â said Bill Sloan, a real estate broker with Re/Max International in Mission Viejo. âIt was one of the best months since we went into the tank in the early â90s. Consumer confidence is back.â

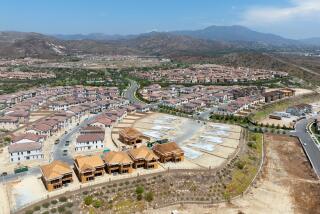

Terry Francisco, 32, and Anne Broadbent, 27, said better market conditions are the reason they are about to close escrow on a $175,000, three-bedroom home in Rancho Santa Margarita. The couple are getting married in June.

âThe homes in Rancho were going pretty quickly in the $100,000 to $200,000 range, so we thought it was a good idea to buy now,â said Francisco.

Broadbent said increasing mortgage rates were another major consideration. Although 30-year fixed rates dipped below 7% in early February--the lowest levels in two years--in recent months mortgage rates have steadily increased.

*

Much of Aprilâs boost in closed escrow sales can be attributed to low interest rates in February, since closed escrows reflect sales of homes weeks earlier. Recent slight increases in rates are also pushing buyers such as Francisco and Broadbent into new homes for fear theyâll face higher borrowing costs if they wait. But experts note that rising rates ultimately make home buying unaffordable for many.

The rate on a conforming 30-year, fixed-rate mortgage in Orange County in early March was 7.548% with two points. By April, that rate had risen to 7.798%, and by May 1 it had increased to 8.01%, according to Mortgage News in Santa Ana.

Another increase in rates last week is expected to help boost sales temporarily, as prospective buyers nervously contemplate the risks of waiting. Still, increasing rates ultimately could prove especially damaging to sales of lower-priced homes where buyers are sensitive to even a slight ascent in borrowing costs.

âRates are pushing some buyers off the fence, but are disqualifying a lot of them too,â said Walter Hahn, an economist with E&Y; Kenneth Leventhal Real Estate Group in Newport Beach.

Hahn said he was concerned that increasing rates will dampen any recovery in Orange County home sales.

âWhat is selling in Orange County is still the low-priced housing. And higher interest rates will have a dampening effect on that,â said Hahn.

*

Southern Californiaâs real estate recession began about five years ago and has caused home sales and values to fall dramatically. While housing activity improved in 1994, poor weather and the Orange County bankruptcy damaged the market in 1995.

In the first few months of this year, sales have improved from the previous year, as buyers have begun buying new and resale homes throughout Orange County.

âConfidence in the economy has returned,â said Rudy Sverck, vice president of sales and marketing for the Irvine Co., Orange Countyâs largest landowner. âLast week was a great week and we expect things to continue to improve.â

* BY THE NUMBERS

A ZIP Code by ZIP Code look at O.C. home sales and prices. D1

(BEGIN TEXT OF INFOBOX / INFOGRAPHIC)

Sales of the South

Five South County areas had the most home sales in April. Sales and percentage change from April 1995:

*--*

ZIP Area Sales % increase 92677 Laguna Niguel 152 46.2 92679 Trabuco/Coto 128 141.5 92656 Aliso Viejo 124 14.8 92688 R. Santa Margarita 114 96.6 92692 Mission Viejo 107 52.9

*--*

Source: Dataquick Information Systems

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production â and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.