2 Charged in Defrauding of Mortgage Investors : Real estate: Authorities describe scheme to resell home mortgages many times over as âblatantâ example of firms that falsify documents. Investors lost more than $1 million.

SANTA ANA â In what authorities say is one of the areaâs most blatant real estate frauds, two Newport Beach businessmen were charged Friday with 28 counts of grand theft in an alleged home mortgage scam that may have bilked investors of more than $1 million.

Authorities said investors were drawn from all areas of Orange County and were provided with falsified documents for the purchase of interests in home mortgages that in some cases had been sold many times over.

On three separate occasions, for example, authorities allege that David James Cook and Joseph Anthony Veltre, both American Federal Mortgage Corp. executives, sold interests on a home loan in which the borrower was a deceased Orange man.

âYou often have cases where institutions have provided false information about properties, but this is certainly one of the most blatant examples,â Deputy Dist. Atty. Daniel B. McNerney said. âThis goes far beyond the simple hedging or puffing of real estate information.â

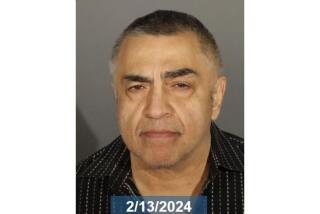

Cook, 48, was being held Friday in the Orange County Jail on bonds totaling $250,000. McNerney said that arrangements had been made for Veltre, 41, to surrender to authorities on Monday.

If convicted, each faces maximum prison sentences of 12 years and fines and restitution payments totaling $1.2 million.

Neither the suspects nor Veltreâs attorney could be reached for comment. Cookâs attorney, James Riddet, declined to comment on the charges, but said he would work Monday to reduce his clientâs bond.

McNerney said the mortgage company at 4299 MacArthur Blvd. in Newport Beach, which opened in 1989, has ceased operation. Newport Beach Police Sgt. Andy Gonis said Cook was arrested Thursday evening without incident at the company offices.

Authorities from the California Department of Real Estate, Newport Beach police and the district attorneyâs fraud unit embarked on the investigation late last year when the first of more than a dozen investors brought their complaints of late or missed interest payments to police.

The company used the promise of a healthy 15% monthly return on investments to recruit business partners, police said.

âThe rate of return was very attractive, without being too good to be true,â McNerney said. âThey took anybody who had money. They didnât discriminate.â

McNerney said the average investment ranged from $40,000 to $50,000.

In December, police served the first of several search warrants at American Federal Mortgage Corp. and recovered boxes of allegedly falsified documents and a counterfeit Orange County Recorderâs Office stamp that was used to make property deeds appear authentic, police said.

âWeâre finding fraud in virtually every transaction,â McNerney said, âand weâve got more boxes to go through.â

Thomas W. Stipe is one of the dozen alleged victims in the case. Until late last week, he also served as the mortgage companyâs attorney. Stipe said he advised the company for more than two years and even helped recruit investors--one of whom was his wife--whose potential losses could top more than $200,000.

Now working with authorities, Stipe has estimated that investments totaling more than $2 million could be in jeopardy. The attorney, who also provides legal advice on a local radio talk show, said he never suspected possible wrongdoing since all the companyâs documents appeared to be authentic.

âA lot of people invested in this company because they relied on me,â Stipe said in an interview Friday. âFor that, I feel awful.â

Later, in a written statement he distributed, Stipe said: âI have been living in the midst of evil and in my idealism I failed to realize my peril. As a consequence of my failure to see what was plainly rotten, my wife and many of my friends and clients have been defrauded out of millions of dollars.â

During his association with the company, Stipe said, he considered Cook a friend and became socially involved with Cookâs family.

âThis evil was at my birthday parties, joined me at the theater; met me at the Ritz and Chanteclair; came with his wife to dine at my house; talked to me on the phone every day; was a great client and loved my wife like his sister,â Stipe said. âThis evil was one of my best friends.â

In one series of transactions, McNerney said, the company allegedly forged the signature of Orange resident Robert Thomas months after he had died in order to sell interests on a home mortgage in Thomasâ name.

âThey sold the same deal at least three times,â McNerney said. âWe believe more of this kind of thing is going on out there.â

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.