The Idea of ‘Resource War’ Has a Last Fling in the Gulf

- Share via

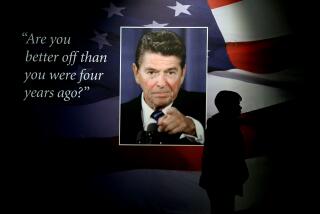

In the Persian Gulf, is Ronald Reagan giving the “resource war” a last fling, supposedly protecting the West’s source of scarce raw material--oil? Resource war was a term Reagan coined during the 1980 presidential campaign. It was to be a major element in justifying a 600-fleet navy and for repairing relations with mineral-rich South Africa, and now in part for the U.S. involvement in the Gulf.

In truth, back in 1980 Reagan had been provoked into the philosophy of the resource war by the liberal-left, which had talked ominously and for too long of a greedy industrial world running out of raw materials. The club of Rome had warned of exponential growth that would lead suddenly to calamitous shortfalls in important commodities. The hype gained credibility from the early years of OPEC’s success. Then, hard on the heels of the oil cartel, the copper, iron ore, bauxite phosphates and coffee producers rushed to form their own cartels.

Lenin’s observation that capitalist economies were inevitably imperialistic because of their need to secure access to raw materials became, during the Reagan campaign, the held conviction of conservative thinkers.

Unless the West secured its lifelines, they argued, the Soviet Union and its allies in the Middle East and in the southern African Marxist-orientated governments and “liberation” movements would cut off the West at its knees.

Yet, barely had this strange confluence of political thought met, than the evidence they all drew upon began to disintegrate. OPEC fell apart and commodity prices took their severest plunge since the Great Depression. Only recently, after six continuous years of decline, are prices showing signs of turning up.

No cartel that man could fashion could stop the fall.

It is strange, then, that after the Reagan Administration, along with everyone else, had gradually walked away from the doomsday scenario of world shortage of raw materials that it should be planning to resurrect the argument in the Gulf. Not surprisingly, it had trouble convincing the West Europeans and Japanese of its case, even though they import far more oil from this region than the United States.

Ironically, it was only a few months ago that President Reagan announced that he wanted to reduce the national defense stockpile--the United States’s strategic reserves of key raw materials. Reagan argued that it was unnecessarily expensive.

He was right, although short-term stockpiles are useful to bridge transitions. The lesson of all raw-material squeezes is that if one source is tied up it will provide the incentive to find another.

Not only has this happened to oil over the last decade and a half, it has happened to a wide range of other relatively scarce raw materials. Chrome, manganese, platinum and vanadium are considered to be the most important strategic non-fuel minerals. They are used in high-performance industries, like aircraft. South Africa has more than three-quarters of the reserves of all these, apart from vanadium, of which it has about half.

Yet as it has become clear that South Africa is potentially an unreliable supplier, mining companies have been finding alternative supplies. In Canada there has been discussion of establishing a plant that would produce vanadium as a by-product of oil-sands exploitation in Alberta. In the past three years Brazil has nearly doubled its manganese output.

Enormous strides have been taken in finding a process to recycle the abundant supplies of platinum contained in the catalytic converters of scrapped cars. Moreover, new industrial materials like ceramics are rapidly displacing traditional natural materials.

The Gulf war is also producing its instinctive antidote. Gulf exporters are now announcing plans to build pipelines that will avoid the waterway by moving their oil by overland pipeline. The supposed stranglehold of the Strait of Hormuz is not much more, in the long run, than a geopolitical fancy. Oil prices have shown little inclination to move sharply upward.

Not surprisingly, it is becoming clearer by the day that the resource-war element in Reagan’s Gulf calculations plays second fiddle to the urge to reduce Soviet influence in the Middle East and to teach Iran that it will not be allowed to peddle its expansionist ideology scot-free.

Hopefully, after we exit intact the Gulf crisis and we have finally absorbed what it was all about, the scarce raw-materials argument will be finally laid to rest.

It was a false hare, egged on by the ideologues of right and left to justify their own particular causes. But it was misleading, dangerously so. The world, not least the Middle East and southern Africa, is complicated enough without the need for added argument.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.