Competition in L. A. Area : Hotel Industry Says âBe My Guestâ

Intense competition for guests and multiplicity of lodging options have raised speculation among hotel owners and potential investors about what and where to build.

While competition exists between hotels in the same vicinity, it has not had the overall impact of the on-again, off-again rate wars in the airline travel industry.

Hoteliers are most concerned with the threat of overbuilding, the need to upgrade and save outdated properties and marketing and managerial skills in keeping a hotel in business.

Some wonder if the hotel industry is simply in a shake-out period that reflects a healthy, evolving change, while other industry sources agree that the question of how and when to build is becoming more difficult to answer.

State Greatest Potential

Hyatt, one of the leading hotel chains, is a good example of the trends in an industry in a state of flux. Already operating seven hotels in the Los Angeles-Long Beach area, Hyatt considers California its greatest potential for future development and has just opened a development office in Newport Beach, the only one outside of its headquarters in Chicago.

Jay Maxwell, head of the new office, said that âwhile industry analysts cry that the industry is overbuilt and occupancies continue to drop, the Hyatt chain is now in the midst of one of its most aggressive expansion programs.

âIn our first 30 years, we opened 85 hotels; in the next five years, we plan to open 50 more in the U. S., Canada and the Caribbean.â

In one of several interviews with executives within the U. S. hotel industry, Saul F. Leonard, national partner of the certified public accounting firm of Laventhol & Horwathâs leisure time industries division, said the hotel market has been volatile and expansion-oriented in recent years and that by 1988, the somewhat lopsided supply/demand ratio of today would become more balanced.

Supply Outstrips Demand

âThe diversity of lodging products has increased and created a supply far greater than the demand necessitated,â Leonard said.

His firm forecasts a slowdown in development for the industry during 1987, flat occupancies and sluggish room rates, and a need for financial reassessment, all of which points to a strong buyerâs market that will continue for as long as a surplus of rooms exists.

Other hotel sources noted that unlike the airlines, the hotel industry must cater to a broader spectrum of competition.

For the most part, current hotel investment is an educated guess, says Roger Halpert, group manager for the real estate division of M. C. S. Associates, a Newport Beach-based consulting firm to financial institutions making loans to the lodging industry.

Difficult Prediction

âItâs difficult for a hotel investor to predict how many other hotels will be built in a given area, therefore how much competition a developer is likely to be up against,â he said.

âIn Orange County, where hotel occupancy is low due to an oversupply of hotel rooms resulting from a rash of building, we have the classic case of supply growing at a faster pace than the demand.â

âOn the demand side, determining occupancy factors may hinge on weather and the general level of the economy. Who could have foreseen the situation in Houston and the dramatic drop-off in demand for hotel rooms (and services in general) which occurred when the oil industry went sour?â Halpert asked.

The hotel development boom of a few years ago has suffered from saturation, changing market demands and will feel the pinch of the Tax Reform Act of 1986, he added.

Elimination of Provisions

The real estate provisions expected to have a negative impact on hotel development are the elimination of the investment tax credit, reduction of tax credit for historic buildings, lengthened depreciation periods, elimination of special capital gains treatment on sale of assets and severe limitations on the deductibility of real estate âpassive lossesâ by individual investors.

In its newly issued 1987 analysis for the state Office of Tourism, the Los Angeles-based accounting firm of Pannell Kerr Forster, estimates new growth in hotel and motel rooms in the Greater Los Angeles area this year at a strong rate of 7.2%.

But a projected increase in overall demand for the stateâs largest lodging market will mean a slight reduction in hotel occupancy rates for the region as a whole. That will result in a projected annual occupancy rate this year of 67.7% compared to a 68.2% last year. For California, as a whole, the projected rate is 66.9%.

A veteran general manager of a downtown hotel said investors can achieve a break-even point at 55%, depending on the debt service for the property.

Investors Seek Prestige

âFor most of the hotel facilities now being built or projected for the near future,â said James E. Burba, a principal in the PKF accounting firm, âthe ones that expect to be on line for a lionâs share of lodging market profits will have to be linked to formats sharply focused on better management and service, rather than geared to the whims of wealthy investors vying for prestige hotel ownership and tax incentives.â

The consumer is now a lot more sophisticated about choices and the value he can get for his money. If he is willing to pay $200 a night for a room, he expects $200 worth of value and itâs no different where a hotel guest only pays $65 for an overnight stay. He or she is entitled to and expects full value for that price, experts say.

The PKF survey of average daily hotel rates for the past 15 years shows a $19.69 average daily rate in 1970, compared with $66.51 in 1985. West Los Angeles shows the highest average rate of $26.28 for 1970 and $104.76 in 1985, while the Los Angeles International Airport area rose from $18.32 to $58.8 in that same period.

Focusing on the Greater Los Angeles area, Jack R. Rodman, managing partner of Kenneth Leventhal, Century City, a consultant in the real estate industry, referred to the greater metropolitan region as a series of nodules or segments that are not integrated.

âCannot Generalizeâ

âWhen we look at the Southland and try to determine whatâs happening, we cannot generalize. We have to consider certain distinct areas, each with its own synergism.â

Peter S. Carlsen, who manages the firmâs hospitality consulting services, reviewed some of the segments of the Greater Los Angeles area, pinpointing some of what is already in place and what is likely to occur in the near future in hotel development.

He categorized the desert communities and the active San Diego area as regional and separate in this analysis, but included Orange County as interlinked with the L. A. area.

âThe LAX area, the regionâs largest lodging submarket, is currently expanding a little to the south as evidenced by the new Embassy Suites on Imperial Highway, and the Marriott Courtyard and the Doubletree Compri, now under construction,â Carlsen said.

Santa Monica Activity

âAnd we have the Marina del Rey area that is somewhat unique with new properties going in close to the new Marina Beach Hotel, such as the Marina Plaza and a proposed Ritz Carlton.â

Hotel activity in Santa Monica is sparking, with financing and city approval in place for a proposed Hyatt Regency or Loews facility. It is a good market, Carlsen stated, but one that is difficult to enter because of the cityâs stringent building codes.

West Los Angeles, which tends to interact with the International Airport area, is more residential in feeling and is a good market for the smaller properties, he added, serving the office corridors emerging on the Westside. Century City is a gateway to Beverly Hills and well positioned with increasing activity going on in a southerly direction.

In addition to the existing Century Plaza Hotel & Towers, there is a new Marriott under construction, and a Days Inn and Charles Hou hotel being built on Olympic Boulevard just west of Century City.

San Fernando Valley

While not yet a mature market, hotel development has become quite vigorous in the San Fernando Valley, with a definite subsegment of the lodging picture branching off at Thousand Oaks and heading on toward Camarillo to the west.

The central valley core is dominated by the Marriott at Warner Center and the Hilton at Sherman Oaks, and on the eastern portion by the high-end products at Universal City.

Industry leaders also look to Pasadena as a separate market entity, along with Torrance and South Bay/Long Beach, an area that is strongly influenced by the Japanese auto industry and Pacific Rim-related commerce. And they include neighboring Anaheim in Orange County, the Interstate 5 corridor and the Newport Beach area, all as part of the greater metropolitan picture.

âPasadena is a well-recognized name and thereâs a lot of high-tech going on there,â Carlsen said. âBut profit in the lodging market is not as good because you have a lot of older hotels.

Hotel Life Span

âWe may begin to see a better lodging outlook as Colorado Boulevard and Lake Avenue develop and modernize. The Huntington Sheraton, now closed, is a good example of a grand old property that satisfied a need but which may require considerable retrofitting to re-enter the scene.

The economic life span of a regular hotel must always be taken into account, experts say. In years past, the useful and competitive life of a hotel was between 30 and 50 years.

Now it is more like 15 years, and a hotel that remains in a status quo position will inevitably be weeded out. That is not to say that unique old structures cannot become enormously successful, industry sources agree.

Orange County represents the biggest and quickest changing market in the Southern California region, going from smaller properties to a real proliferation of high-end hotels because of the economics and the demographics perception of that area, Carlsen reported. âBut right now itâs a very tough market with more rooms on line chasing groups of travelers that are not increasing as much as was hoped for.â

Hollywood Future

Anaheim is in the best shape, he added. It has Disneyland and the convention center serving as the two most significant generators of the demand in that area.

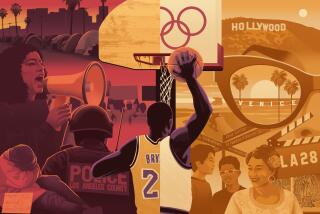

Hollywood, now in the throes of rejuvenation, can look forward to a more optimistic future for its lodging capability, boosted by a number of projects being launched to coincide with its current 100th anniversary celebration. Included among them is the projected 400-room hotel of Melvin Simonâs Hollywood Promenade at Highland Avenue and Hollywood Boulevard.

Projects in the Los Angeles downtown area are at a slower pace of development, according to lodging pulse-takers, but in a decade or so should show significant market strength.

New development of commercial office and retail space is attracting international and domestic firms to the area, and the strong growth, according to the Pannell, Kerr, Forster study has fueled higher aggregate hotel occupancy, which increased from 61.9% in 1985 to 64.6% in 1986.

Extensive Renovations

There is talk of new projects planned, a possible Ritz Carlton and/or Intercontinental Hotel, another at Pershing Square, and an opportunity for a new hotel in the convention center with its proposed expansion.

Several major hotels in the area have undergone extensive renovation to an enhanced suite format and, as a result, there has been a contraction in the downtown hotel room supply with the Biltmore losing 300 of its rooms (from 1,022 to 722) and the Los Angeles Hilton about 264 rooms (from 1,165 to 901).

Thus far, the downtown market has been dominated by commercial and small convention groups, with some demand for the more affordable rates offered by hotels like the Alexandria, and convenience and service of the University Hilton, Holiday Inn and Figueroa hotels which have traditionally attracted a large portion of price-sensitive travelers.

âAttention to Detailâ

Leventhalâs Jack Rodman believes Los Angeles still suffers from a lack of really first-class facilities.

âThe Westin Bonaventure is stunning on the outside, the Sheraton Grande is still the best that is currently downtown but there is still not enough of the attention to detail we expect of the true-luxury facilities like a Four Seasons, a Ritz Carlton or a Mandarin,â he said.

Industry opinion is that downtown has two problems that keep it from being a good weekend market--the inability of the Los Angeles Convention Center to bring in significant conventions and the lack of the evening and weekend activity that would lure the weekend guest.

Expects Business Increase

Chris Morita, administrative assistant at the Los Angeles Convention Center, said that the anticipated $350-million expansion of the center will boost business from out of town. She reported that during the fiscal year of 1985-86, the Convention Center showed an attendance of 258,739 out-of-towners, which translated to expenditure figures on a daily basis of up to $123,838,210. Total overall attendance at the center was 1,527,945, representing a five to one ratio in local attendance compared to out-of-town attendance.

The expansion is targeted for completion in 1991 and should add 375,000 square feet of exhibit space, a new parking structure, auditorium, banquet space and will increase its existing 21 meeting rooms to 61. These plans are currently being developed by Gruen Associates of Los Angeles in joint venture with I. M. Pei of New York.

Prospects for utilizing some remaining county land on 1st Street in conjunction with the expansion of the Music Center and a mixed-use complex with possibly a hotel is being considered. It is expected that the new Museum of Contemporary Art and what is happening at California Plaza may create enough of a sub-market to attract people who will want to experience downtownâs restaurants, theater and other night-life activity.

In redirecting their development strategies, investors are seeing a need to cater to the needs and preferences of a wider range of users--traveling for pleasure or business--and they are having to pay more attention to the marketing and packaging of their products.

Specialized Products

They have become more innovative and are exploring new opportunities through the introduction of specialized products, such as the all-suite hotels, conference centers and destination/resort facilities, often as the off-shoots of major established hotel chains or newly formed entities.

General consensus in the industry is that the all-suite format, at the high and low ends of the spectrum, has taken the lead. At the higher-rate levels, Carlsen mentioned preferred options like the Embassy Suites, Residence Inns and Quality Suites and in the moderately priced category, also doing well--the Lexington Suites and Comfort Suites.

Vintage Hotels

And, in evidence throughout the Southland, is the upgrading of vintage hotel chains for greater economic efficiency and product consistency.

Areas that will best support new hotels, industry experts say, include Santa Monica, Marina del Rey, the South Bay area, Pasadena, Torrance and certain parts of Beverly Hills, if one were allowed to build them there. Others include the western portion of the San Fernando Valley.

According to Carlsen, areas that need to be avoided for a while include Palm Springs, âso they can get a chance to shake out what we expect will be a very tough market. The Newport Beach Bay area also needs to be avoided for awhile to give these hotels a chance to get a foothold in that market, establish their identity and build up some business.â

GREATER LOS ANGELES Summary of Market Performance

Actual Estimated Percent 1985 1986 change Number of properties 435 455 4.6% Number of rooms 57,561 60,635 5.3 Annual available rooms 21,010,000 22,131,000 5.3 Annual occupied rooms 14,312,000 15,092,000 5.5 Occupancy level 68.1% 68.2% .1

Projected Percent 1987 change Number of properties 472 3.7% Number of rooms 64,995 7.2 Annual available rooms 23,723,000 7.2 Annual occupied rooms 16,071,000 6.5 Occupancy level 67.7% (.7)

Source: Pannell Kerr Forster DOWNTOWN LOS ANGELES / Greater Los Angeles Summary of Market Performance

Actual Estimated Percent Projected 1985 1986 change 1987 Number of properties 35 35 -% 36 Number of rooms 7,610 7,792 2.4 7,981 Annual available rooms 2,778,000 2,844,000 2.4 2,913,000 Annual occupied rooms 1,720,000 1,837,000 6.8 1,912,000 Occupancy level 61.9% 64.6% 4.4 65.6%

Percent change Number of properties 2.7% Number of rooms 2.4 Annual available rooms 2.4 Annual occupied rooms 4.1 Occupancy level 1.5

Source: Pannell Kerr Forster LAX AREA / Greater Los Angeles Summary of Market Performance

Actual Estimated Percent Projected 1985 1986 change 1987 Number of properties 45 46 2.2% 46 Number of rooms 11,186 11,871 6.1 12,383 Annual available rooms 4,083,000 4,333,000 6.1 4,520,000 Annual occupied rooms 2,923,000 3,068,000 5.0 3,160,000 Occupancy level 71.6% 70.8% (1.1) 70.0%

Percent change Number of properties --% Number of rooms 4.3 Annual available rooms 4.3 Annual occupied rooms 3.0 Occupancy level (1.1)

Source: Pannell Kerr Forster WEST LOS ANGELES AREA / Greater Los Angeles Summary of Market Performance

Actual Estimated Percent Projected 1985 1986 change 1987 Number of properties 60 60 --% 63 Number of rooms 8,187 8,187 -- 8,445 Annual available rooms 2,988,000 2,988,000 -- 3,082,000 Annual occupied rooms 1,999,000 2,083,000 4.2 2,206,000 Occupancy level 66.9% 69.7% 4.2 71.6%

Percent change Number of properties 5.0% Number of rooms 3.2 Annual available rooms 3.2 Annual occupied rooms 5.9 Occupancy level 2.7

Source: Pannell Kerr Forster MID-WILSHIRE / HOLLYWOOD / Greater L.A. Summary of Market Performance

Actual Estimated Percent Projected 1985 1986 change 1987 Number of properties 35 37 5.7% 37 Number of rooms 3,813 4,279 12.2 4,444 Annual available rooms 1,392,000 1,562,000 12.2 1,622,000 Annual occupied rooms 851,000 928,000 9.0 962,000 Occupancy level 61.1% 59.4% (2.8) 59.3%

Percent change Number of properties --% Number of rooms 3.9 Annual available rooms 3.9 Annual occupied rooms 3.7 Occupancy level (.2)

Source: Pannell Kerr Forster SOUTH BAY / Greater Los Angeles Summary of Market Performance

Actual Estimated Percent Projected 1985 1986 change 1987 Number of properties 60 64 6.7% 68 Number of rooms 6,794 7,285 7.2 8,576 Annual available rooms 2,480,000 2,659,000 7.2 3,130,000 Annual occupied rooms 1,699,000 1,805,000 6.2 2,060,000 Occupancy level 68.5% 67.9% (.9) 65.8%

Percent change Number of properties 6.3% Number of rooms 17.7 Annual available rooms 17.7 Annual occupied rooms 14.1 Occupancy level (3.1)

Source: Pannell Kerr Forster SAN GABRIEL VALLEY / SOUTH INTERSTATE 5 CORRIDOR / Greater Los Angeles Summary of Market Performance

Actual Estimated Percent Projected 1985 1986 change 1987 Number of properties 102 108 5.9% 110 Number of rooms 10,018 10,341 3.2 11,007 Annual available rooms 3,657,000 3,774,000 3.2 4,018,000 Annual occupied rooms 2,564,000 2,574,000 .4 2,690,000 Occupancy level 70.1% 68.2% (2.7) 66.9%

Percent change Number of properties 1.9% Number of rooms 6.4 Annual available rooms 6.4 Annual occupied rooms 4.5 Occupancy level (1.9)

Source: Pannell Kerr Forster VENTURA COUNTY / Greater Los Angeles Summary of Market Performance

Actual Estimated Percent Projected 1985 1986 change 1987 Number of properties 43 49 14.0% 54 Number of rooms 3,679 4,256 15.7 5,396 Annual available rooms 1,343,000 1,553,000 15.7 1,970,000 Annual occupied rooms 912,000 1,058,000 16.0 1,238,000 Occupancy level 67.9% 68.1% .3 62.8%

Percent change Number of properties 10.2% Number of rooms 26.8 Annual available rooms 26.8 Annual occupied rooms 17.0 Occupancy level (7.8)

Source: Pannell Kerr Forster

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production â and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.