Tax breaks for beer, unborn children are among goodies in Republican bill

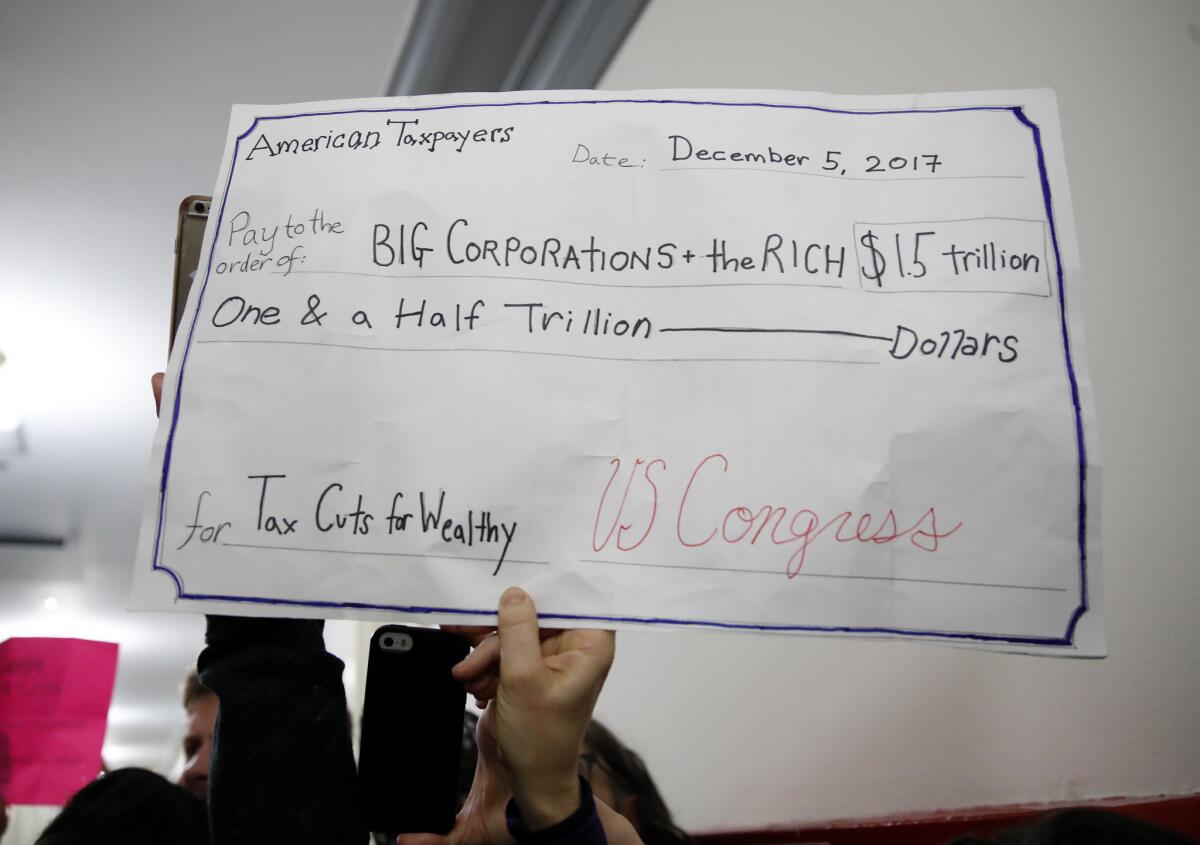

Reporting from Washington — As the House and Senate begin to reconcile their different tax bills, they will have to sort through many little-known provisions that appear designed more to achieve policy goals or reward key lawmakers than deliver tax savings.

Here’s a look at some of the standouts, and their prospects for being including in the final legislation.

The Johnson amendment

The House bill essentially does away with decades-old tax code restrictions preventing churches and other nonprofit groups from engaging in political activities.

Opponents of the restrictions say the groups should have free expression but others worry it will interject politics into philanthropy and open the door to more “dark money” campaigns.

Thousands of churches and charitable organizations oppose the House approach, preferring to keep the restriction, first introduced by then-Sen. Lyndon B. Johnson in 1954.

The provision was not considered in the Senate bill and is unlikely to survive.

“Charities and nonprofits don’t want this,” said Emily Peterson-Cassin, a project coordinator at the watchdog group Public Citizen. “They believe it’s going to be super divisive and open them up to partisan manipulation.”

College savings for the unborn

The House bill would expand 529 college savings accounts to unborn children, specifically recognizing a fetus as a beneficiary in the tax code, a goal of conservative anti-abortion advocates.

“A child in utero means a member of the species homo sapiens, at any stage of development, who is carried in the womb,” the summary says.

The provision did not pass special Senate rules, which prevent budget measures like the tax bill from veering too deeply into policy changes. It will likely fall out of a final bill.

Private jets

Private jet owners have long fought the IRS to avoid a special excise tax that applies to commercial flights, and the Senate bill would permanently allow them to avoid it.

The bill prohibits any new taxes from being imposed on aircraft owners for money spent on “services related to maintenance and support of the aircraft owner’s aircraft, or flights on the aircraft owner’s aircraft.”

Though Democrats have condemned the provision as a tax break for private jets, the National Business Aviation Assn. argued it simply clarifies existing tax law.

The Joint Committee on Taxation estimated it would amount to less than $50 million in potential lost revenue over the decade.

The addition seems like it might fly in the House and be accepted in the final product.

Beer, wine and spirits

The Senate bill provides a tax cut on beer, wine and distillers – which lobbyists say is the first since the Civil War — with a slimmed-down version of the popular and bipartisan Craft Beverage Modernization and Tax Reform Act.

The measure reduces excise taxes on smaller producers – halving the craft beer tax, for example, from $7 a barrel to $3.50 on the first 60,000 barrels produced domestically. And it reduces taxes overall at greater production output.

“Every congressional district in the United States includes a brewery, winery, distillery, importer, or industry supplier,” said the organizations representing brewers in a letter to Congress. “These businesses are often cornerstones of their communities.”

Including the measure was a way to pique the interest of Oregon Sen. Ron Wyden, the top Democrat on the Finance Committee, in the broader tax package, since he was a lead sponsor of the original bill. But he ultimately opposed the Senate overhaul.

The alcohol tax breaks have bipartisan support in the House and Senate and appear poised to remain in the final bill.

University, private foundation endowments

Both the House and Senate bills impose a new, flat 1.4% excise tax on incomes produced by university and other private endowments.

The Senate bill initially carved out an exception that specifically would have helped Hillsdale College in Michigan, a school backed by the wealthy family of Education Secretary Besty DeVos. But after criticism, it was deleted.

Under law, endowments face a tax that can range from 1% to 2%, depending on if they make dispersions.

Colleges and universities are particularly concerned the new tax will hurt operations, and the Yale Daily News reported that top alumni were lobbying Congress to drop it.

It’s unclear if it will remain in the final bill.

Private bonds, stadiums

The House bill repeals the interest deduction on various types of bonds, including private activity bonds often used by municipalities to finance hospitals, housing and other projects.

It also specifically ends the deduction for sports stadium financing and repeals rules for using tax credits in lieu of bond payments.

Local governments worry the change will impede their ability to finance major infrastructure projects, particularly affordable housing.

The Senate does not include the changes and the outlook for keeping them in the final product is uncertain.

Alaska drilling

Tacked onto the Senate bill is a section, Title II, which opens the Arctic National Wildlife Refuge to oil and gas drilling for the first time in a generation.

It does so by imposing a 16.67% royalty on new land leases, a measure included to help win the vote of Alaska GOP Sen. Lisa Murkowski. She has fought for years to open the area to what she believes is responsible drilling, despite protests of environmental groups who warn that industrial extraction will destroy the habitat.

The measure calls for multiple lease sales, at no less than 400,000 acres each, on “areas that have the highest potential for the discovery of hydrocarbons.”

The five-page provision is very likely to remain in the final product.

Cruise lines

The Senate bill initially included a new tax on cruise line operations, which opponents argued would hit tourism in the U.S., including in Alaska.

Sen. Dan Sullivan (R-Alaska) offered an amendment that stripped the provision.

The cruise line tax was not included in the House bill and is not expected to be in the final version.

Member of Congress living expenses

The Senate bill does away with a $3,000 deduction for living expenses that can be taken by members of Congress, who often keep two homes – one in Washington and another in their home states.

Work-releated deductions are repealed in the House bill for various other professions, though a late revision reinstated write-offs for teachers who buy school supplies.

It seems politically tough for lawmakers to reinstate their deduction, if others related to work are repealed. Ending the living expense writeoff will probably stay in the final bill.

ALSO

GOP tax bill is latest example of Senate leader Mitch McConnell breaking the norms he often espouses

More coverage of politics and the White House

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.