GOP House tax bill would deliver blow to California homeowners

President Trump wants House passage of the tax bill by Thanksgiving and Senate passage by the end of the year. (Nov. 2, 2017)

House

The much-anticipated rollout launches a grueling legislative process that will test GOP unity in the coming weeks as the party struggles to deliver one of President’s

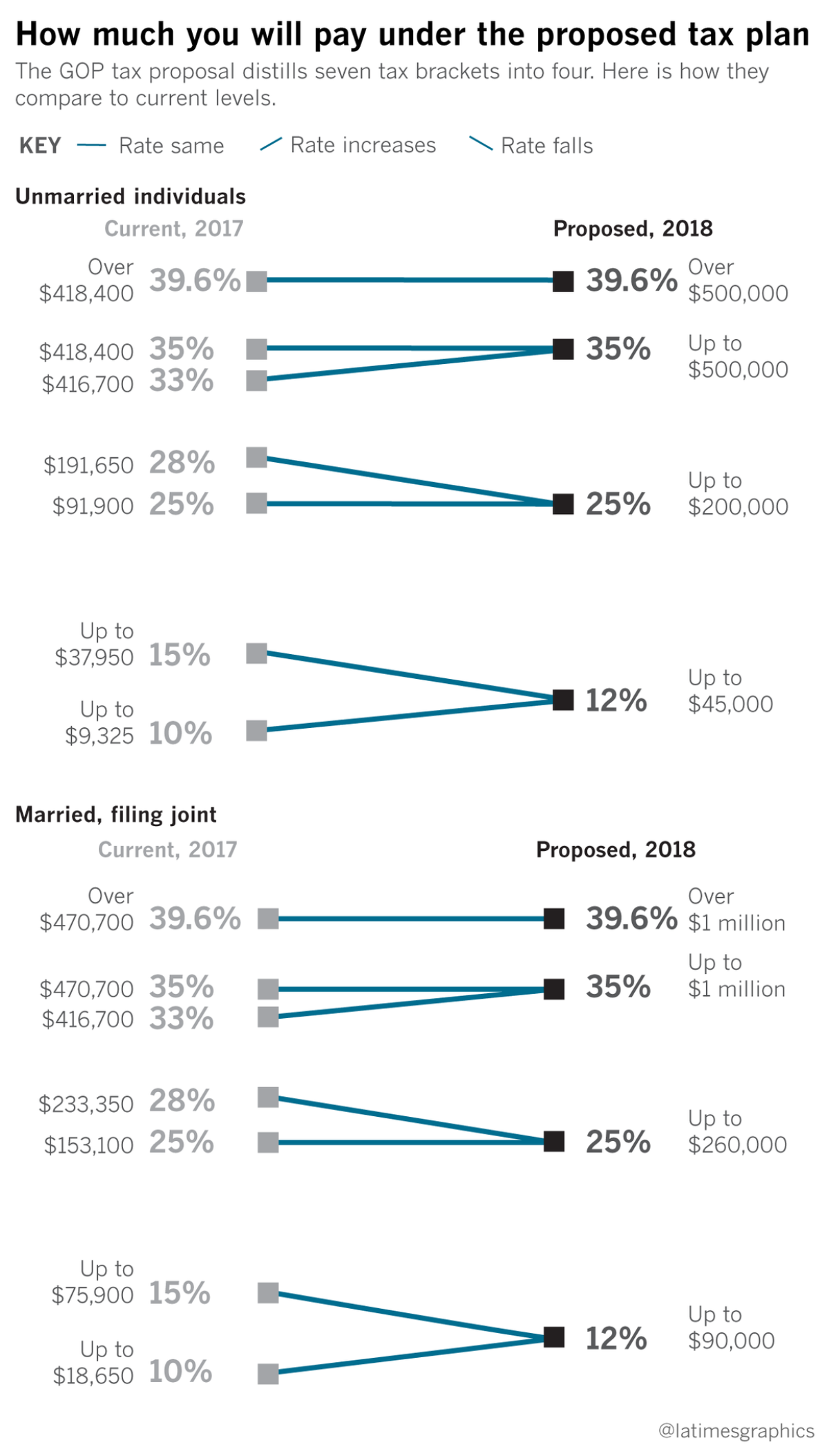

The plan would immediately slash the corporate tax rate to 20% from 35% and streamline individual rates from seven brackets into four.

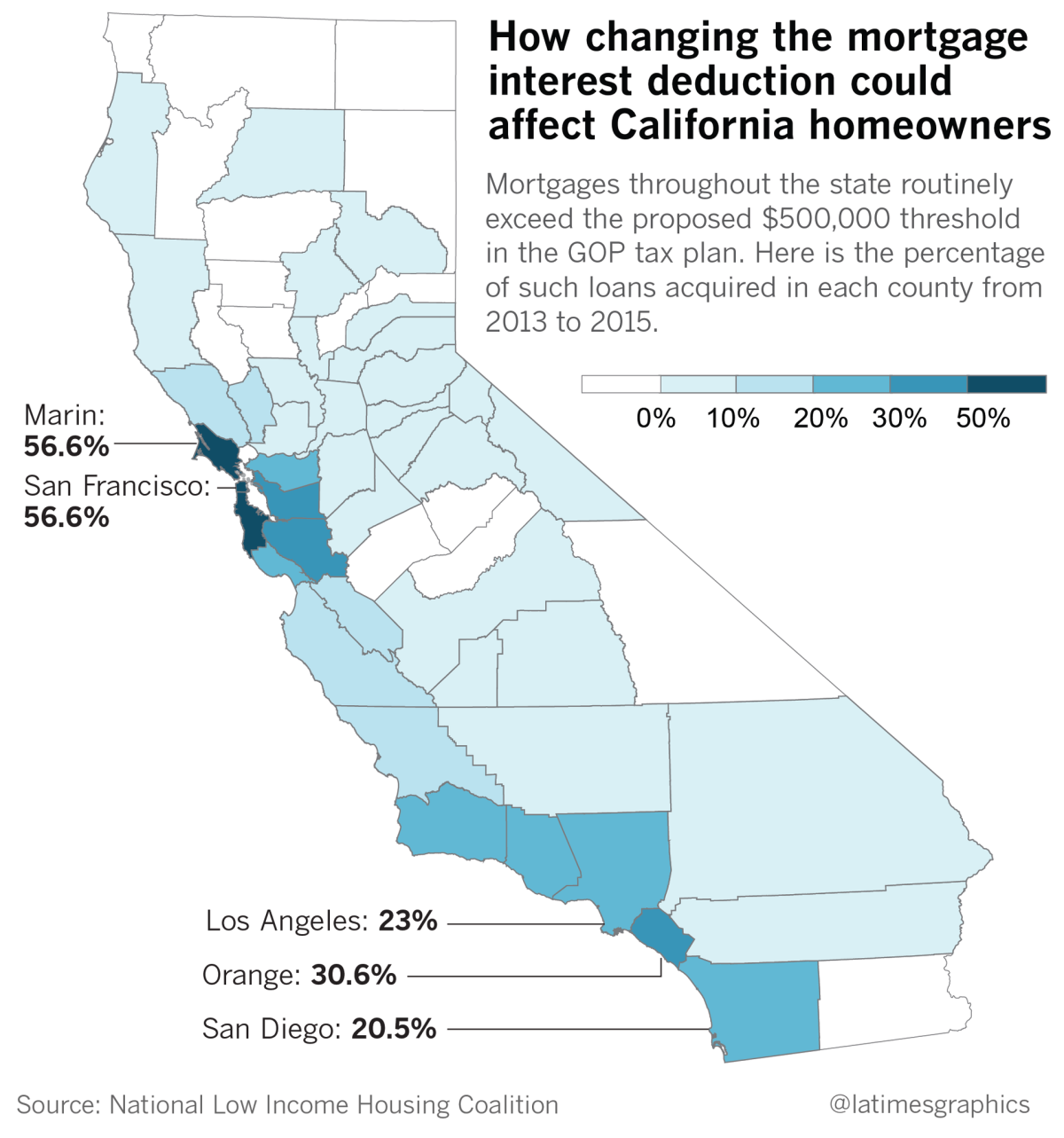

In addition to ending write-offs of state and local income taxes, mortgage interest deductions would be limited to new loans of no more than $500,000, down from the current $1 million. Deductions for second homes would no longer be allowed. Property tax deductions would be capped at $10,000.

Popular 401(k) retirement savings plans used by many Americans were untouched by the bill, despite some efforts to restrict those tax-deferred accounts in a effort to pay for cuts elsewhere.

House Speaker

President Trump praised it as a “massive tax cut for American families” that will lead to the creation of more jobs. He wants Congress to pass the legislation by year end.

“We’re working to give the American people a giant tax cut for Christmas,” Trump said at the White House.

Critics say the 429-page bill, the Tax Cuts and Jobs Act, is skewed heavily toward businesses and the wealthy.

"What we are seeing today is a plan that exacerbates the unfairness and inequality in our tax code," said Senate Minority Leader Charles E. Schumer (D-N.Y.). "The Republican tax plan would put two thumbs down on a scale already tipped towards the wealthy and powerful. ... Surely we can do better."

The plan increases the standard deduction for taxpayers who don’t itemize from $6,350 to $12,000 for individuals, and from $12,700 to $24,000 for couples. But it also eliminates the $4,050 per-person personal exemptions that currently help many taxpayers further lower their bills.

It creates four new tax brackets. For married couples, income from $0 to $90,000 will be taxed at 12%, income from $90,000 to $260,000 will be taxed at 25%, income from $260,000 to $1 million will be taxed at 35% and income above that is taxed at the current top rate of 39.6%.

For individuals, income up to $45,000 will be taxed at 12%, income from $45,000 to $200,000 will be taxed at 25%, income from $200,000 to $500,000 will be taxed at 35% and income above $500,000 is taxed at the current top rate of 39.6%.

Overall, the plan would add $1.5 trillion to the deficit over 10 years, according to the congressional Joint Committee on Taxation. Total tax cuts for individuals would reduce federal revenue by $929 billion over the decade, the committee said. Business cuts domestically would lower federal revenue by $847 billion.

Bill drafters had to scramble to find new revenue sources to offset the loss to federal coffers. Republicans insist the economic growth created by the plan will eventually offset any short-term costs.

But the Peter G. Peterson Foundation, a deficit watchdog, derided the bill in a statement as "an example of fiscal irresponsibility. . . . We need to improve our dangerous fiscal outlook, not make it worse.”

The tax bill is a top priority for Republicans, but passage remains uncertain. Republicans worked on the package in secret, blocking Democratic input, and outside groups — including many GOP allies — gave only tepid support.

Some leading business, including the National Assn. of Home Builders and National Federation of Independent Businesses, have already come out against the plan, complaining it hurts their industries or does not go far enough toward reducing taxes.

The change in mortgage interest deductions, which would only apply to home purchases and mortgages made after Nov. 2 , is likely to deliver a significant blow to California homeowners.

“Eliminating or nullifying the tax incentives for homeownership puts home values and middle-class homeowners at risk, and from a cursory examination, this legislation appears to do just that,” said William E. Brown, president of the National Assn. of Realtors.

Rep Tom MacArthur (R-N.J.) said party leaders "dropped a bomb" with the mortgage interest changes, which blindsided lawmakers and now may risk his vote. "It's all about home ownership for me," he said.

House Ways and Means Committee Chairman

House Minority Leader

Californians would be disproportionately hurt by the change because it has the highest state income tax rate in the nation.

The bill increases the existing $1,000 per child tax credit to $1,600 — a priority for Ivanka Trump, the president’s daughter and adviser — and adds a new family tax credit of $300 for dependents who are not children, such as elderly relatives.

Other popular deductions would be repealed, including alimony payments, adoptions, dependent care programs, medical savings accounts and moving expenses.

“It’s very clear to us that this is a huge tax cut for people in the top tax bracket,” said Chuck Marr, director of federal tax policy at the Center on Budget and Policy Priorities, a liberal think tank.

Education-related deductions – for student loan interest and employer-backed tuition assistance — would also end. Charitable giving would be adjusted, with new limits on deducting costs of sports tickets.

In addition to dropping the corporate rate to its lowest level since 1939, the bill lowers to 25% the top rate paid by so-called pass-through businesses, whose owners file taxes as individuals. Currently, such businesses are taxed at the same rate as individuals, topping at 39.6%. The change may help some small businesses, but also is a boon to law firms, partnerships and real estate companies, including many of Trump’s.

The so-called carried interest tax break, used by managers at hedge funds and private equity firms and others on Wall Street to reduce their tax bills, was retained despite Trump’s criticism of it during the campaign.

The plan also ends the alternative minimum tax, which is used to ensure businesses and the wealthy do not exploit the system to avoid taxes, although it has increasingly affected upper middle-class earners.

And the bill includes a phase-out of the estate tax — a move that mostly benefits the rich and has long been a goal of Republicans. It would double the existing exemption to $11 million for individuals and $22 million for couples starting next year, and fully repeal the tax in 2024.

U.S. corporations would pay a one-time tax on assets currently held abroad -- 12% on cash and 5% on equipment and other illiquid assets. After that, American companies would not pay U.S. taxes on most foreign earnings.

Business groups gave mixed reaction to the plan.

“This bold tax reform bill is exactly what our nation needs to get our economy growing faster," said Neil Bradley, chief policy officer at the U.S. Chamber of Commerce. But he added, "A lot of work remains to be done to get the exact policy mix right and move from a legislative draft to an enacted law."

But the NFIB, which represents small businesses, said it could not support the plan because the new rate favors businesses earning more than $250,000 over mom-and-pop shops. “This bill leaves too many small businesses behind,” NFIB President Juanita Duggan said in a statement.

House Republicans plan to begin debating the bill in the Ways and Means Committee next week, with more amendments and changes expected before the full House votes on it.

Staff writer Sarah D. Wire in Washington D.C. contributed to this report.

ALSO

Conservatives lament retention of top tax rate in GOP plan, but the wealthy still reap big benefits

Is this small-town congressman from New Mexico tough enough to win Democrats the House majority?

More coverage of politics and the White House

UPDATES:

3 p.m.: This article was updated with more analysis and reaction from business groups.

10:25 a.m.: This article was updated with comments from President Trump, Broadcom Chief Executive Hock Tan and details on changes to the estate tax.

8:55 a.m.: This article was updated with comments from House Speaker Paul D. Ryan and the U.S. Chamber of Commerce.

8:35 a.m.: This article was updated with comments from Democrats and Rep. Kevin Brady.

8:15 a.m.: This article was updated with details about income brackets and child care credits.

7:55 a.m.: This article was updated with additional details, including comment from Rep.

7:20 a.m.: This article was updated with additional details.

This article was originally published at 7 a.m.

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.