Jeb Bush unveils tax plan to slash rates for corporations and top earners

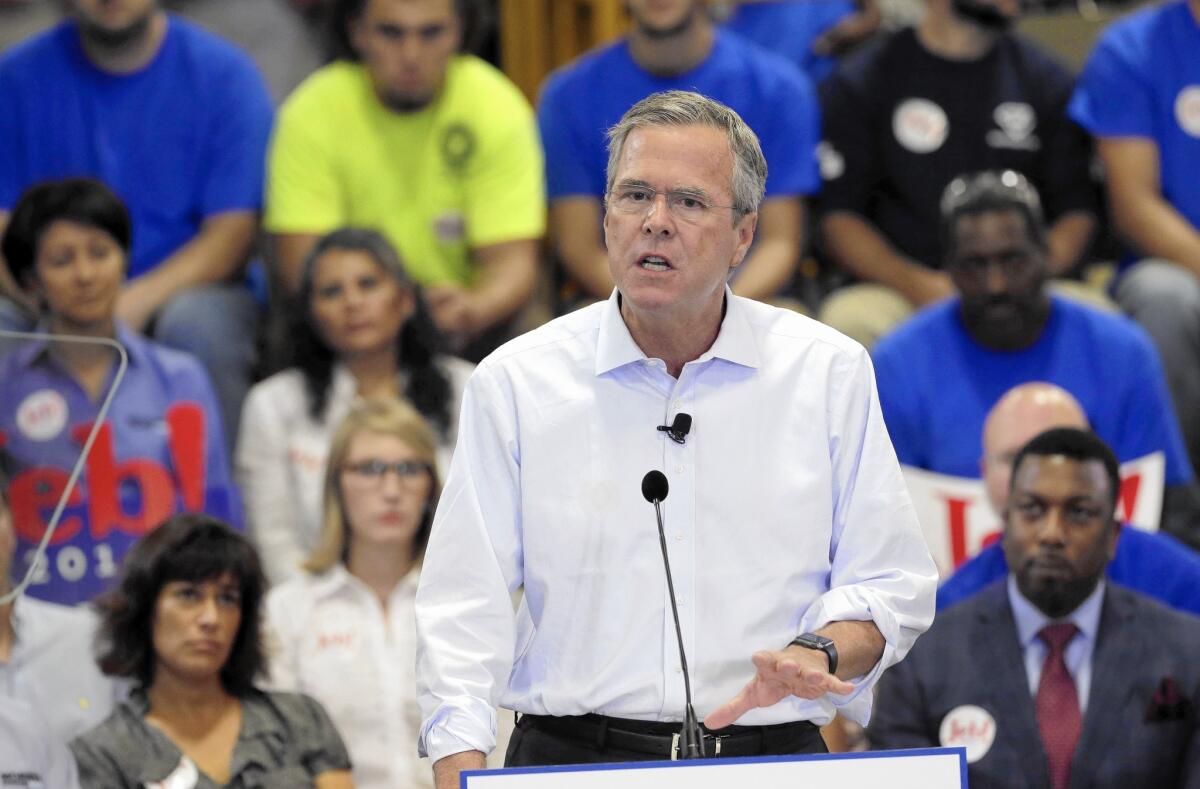

“We need to jump-start our economy, and we can do that by fixing our broken tax code. It’s a disaster. We all know it,” Jeb Bush said during a campaign appearance in Garner, N.C.

Republican presidential candidate Jeb Bush vowed Wednesday to slash personal and corporate taxes, arguing that high rates and a tangled mess of a tax code have hurt American economic growth.

“We need to jump-start our economy, and we can do that by fixing our broken tax code. It’s a disaster. We all know it,” Bush said at an appearance at a manufacturer in Garner, N.C. “Eighty thousand pages…. It’s full of special favors, carve-outs, phaseouts and subsidies — that you pay for, one way or another.”

Democrats criticized Bush’s plan, which would reduce the top federal income tax bracket rate from 39.6% to 28% and corporate taxes from 35% to 20%, as a “disastrous economic agenda” that benefits the wealthy and well-connected.

The proposal “benefits himself, and those like himself, while leaving the middle class out to dry,” said Democratic National Committee spokesman Holly Shulman. “Our country simply can’t afford more trickle-down Bush economics.”

Bush would reduce the number of federal tax brackets from seven to three, with the bottom rate remaining 10%. He calls for nearly doubling the standard deduction, which is used by most tax filers. In 2015, the standard deduction is between $6,300 and $12,600, depending on filing status.

His plan would eliminate the alternative minimum tax, the Affordable Care Act’s 3.8% levy on investment income for high-wage earners, and the estate tax, proposals that would benefit the wealthiest Americans.

Bush would also get rid of the Social Security tax on senior citizens who hold jobs. He would change how married couples with dual incomes are taxed.

Bush calls for expanding the earned income tax credit, which would help the poor. Families of four earning under $40,000 would pay no federal income tax.

“Of all the terrible things that can be said about our tax code,” Bush said, “and I can think of a few, the worst is probably this: It punishes people for doing things we should encourage and rewards people for doing things that may not be so good.”

Some of his proposals could hit Californians — and other residents of high-tax states with high housing costs — harder than other parts of the country. Bush would eliminate the deduction of state and local taxes. And he calls for capping deductions, except for charitable donations, a move that would greatly affect the taxable income of people who deduct large mortgage interest payments.

In addition to reducing the corporate income tax, Bush would end extra taxes on overseas profit and allow repatriation of $2 trillion in profit stored overseas at an 8.75% tax rate over a decade.

He proposes allowing businesses to deduct new capital investment costs immediately rather than over time, and for eliminating the deduction of interest on loans.

“We will put Main Street and Wall Street on even footing,” Bush said.

“If your business model depends on heavy debt and leverage, that’s your choice. Under my plan, you’ll pay for it.”

One of Bush’s proposals — to tax the income of private equity and hedge fund managers as normal income rather than capital gains — is likely to draw opposition from Wall Street.

Sen. Rand Paul, a rival for the GOP presidential nomination who has called for repealing the tax code and replacing it with a 14.5% flat tax, attacked Bush’s proposal for not going far enough. He accused Bush of “tiptoeing” around the edges.

“You can’t defeat the Washington Machine by tearing out a couple of pages of our over 70,000 page tax code,” Paul emailed supporters. “You need to drive a stake through the heart of the IRS.”

Though Bush’s tax proposal is not as radical as Paul’s, it would represent “major changes” to the tax code, said Roberton Williams, a senior fellow at the Urban-Brookings Tax Policy Center at the Urban Institute.

Bush said that his plan, along with other efforts such as regulatory relief, would double the nation’s economic growth to 4% and create 19 million jobs, growing the tax base. And some of the reduced tax revenue would be offset by the reduced deductions.

It’s unclear how Bush’s plan would pencil out. But an analysis by economists from Stanford’s conservative Hoover Institution and Harvard and Columbia universities found it would result in the loss of $1.2 trillion to $3.4 trillion‎ in revenue over a decade.

“It’s a lot of tax cuts,” Williams said, adding that additional analysis is necessary. “On the face of it, it looks like a big revenue loser. I don’t know how it makes up the revenue it seems to lose with the rate cuts, which are very large, particularly at the top end and particularly on the corporate side.”

Twitter: @LATSeema

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.