News Corp. shareholders approve of split into 2 companies

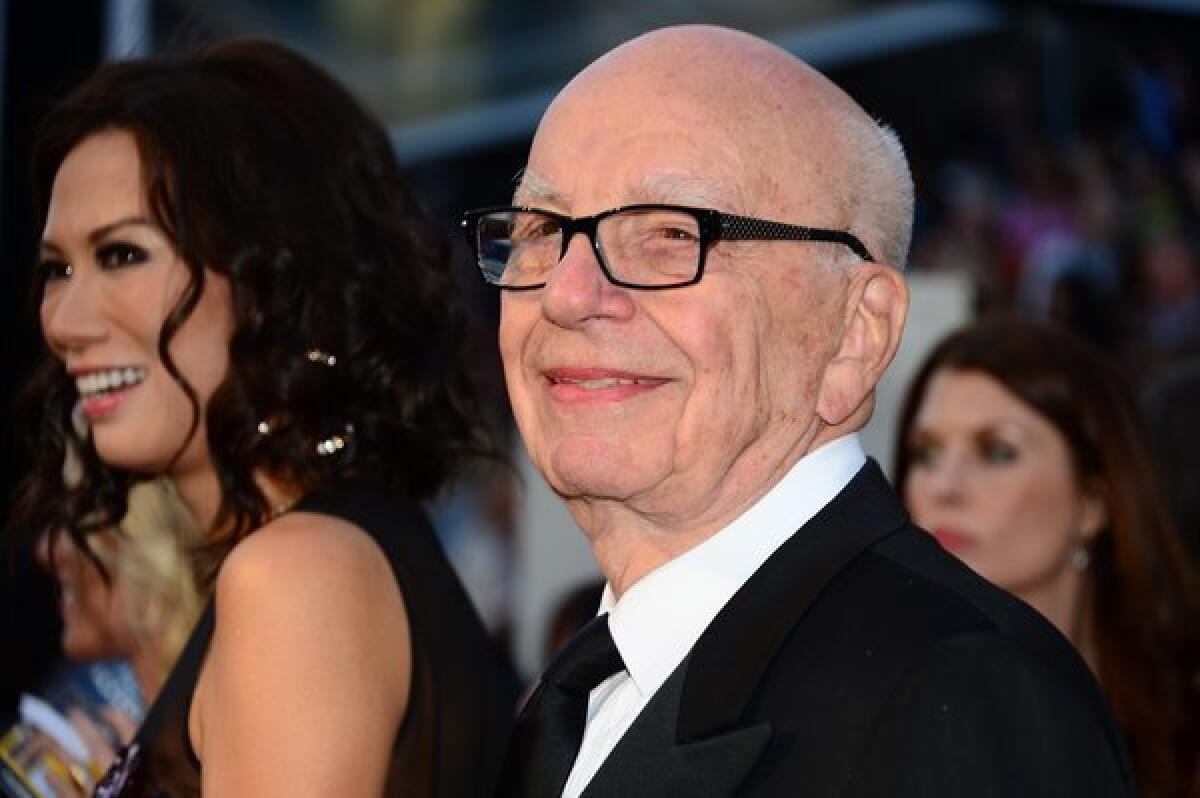

News Corp. has moved closer to its historic breakup that is expected to test whether investors share Chairman Rupert Murdochâs confidence that there is a solid future for newspapers.

On Tuesday, shareholders approved measures that will allow Murdochâs sprawling media empire to be cleaved into two separate publicly traded companies. The most profitable assets â Fox News Channel, the Fox broadcast TV network, Fox regional sports networks, FX and the 20th Century Fox movie studio â will form 21st Century Fox Inc.

The publishing assets, including the Wall Street Journal, Times of London, New York Post, the Australian, HarperCollins book publishing house and several Australian television properties, will form a separate company. Murdoch said the new entity, which will bear the News Corp. name and boast 120 newspapers, will make up the largest publishing operation in the English-speaking world.

PHOTOS: Hollywood Backlot moments

During Tuesdayâs 23-minute special meeting in New York, Murdoch announced that âan overwhelming majorityâ of shareholders had favored three measures designed to facilitate the separation, planned for June 28. Shares in the two companies will begin trading separately July 1.

âThank you for your support,â the 82-year-old media baron said.

Wall Street long has been sour on Murdochâs enthusiasm for the newspaper business, and News Corp. traded at a discount to other media stocks until last summer when the company announced its plans to peel off the newspapers as a stand-alone publicly traded company. News Corp.âs stock is up more than 50% in the last year, since news of the breakup became public.

âMurdoch loves his newspapers, almost in an irrational way,â newspaper analyst Alan Mutter said in an interview. âBy severing the newspapers from the rest of the company, he has appeased shareholders and also given the newspapers a fighting chance to sustain themselves.â

After the spinoff, shareholders will be able to decide whether to keep or sell their stock in the publishing company, without changing their holdings in 21st Century Fox. The new structure should ensure that holdover investors also are betting on News Corp.âs print properties.

After years of resistance, Murdoch decided to break up the company, in part, so the newspapers could draw on a more supportive group of investors and a dedicated management team, headed by former Wall Street Journal managing editor Robert Thomson.

PHOTOS: Celebrities by The Times

Without such protections in place, and without Murdoch at the helm, the newspapers might not have survived as part of the global entertainment company.

If Murdoch âgot hit by a bus, his second-in-command would get rid of the newspapers in a New York minute,â Mutter said.

The new News Corp. will spring to life with no debt and $2.6 billion in cash to fund operations, upgrade equipment and make acquisitions. News Corp. executives have refused to say what properties they might be eyeing, but Murdoch has privately expressed an interest in acquiring the Los Angeles Times.

Two weeks ago, shareholders packed an investor day conference held to introduce key managers and discuss News Corp.âs strategy for the publishing company. There, Murdoch was characteristically upbeat about newspapersâ prospects, stating that âknowledge is the most valuable commodity in the world; and never has a more ravenous appetite for knowledge existed than today.â

News Corp. expects its book publishing revenue to stabilize because profit margins are higher for electronic books than for hard copies. For its news and information properties, company managers outlined a strategy centered around growing subscription revenue, which they believe will offset declines in advertising revenue. The company also plans to experiment with different online windows of availability for news content.

âBy embracing a digital/mobile world, [Murdoch] believes new News Corp. will be able to recreate his boot-strapping of the original News Corp., this time in an accelerated timeframe,â Bernstein & Co. media analyst Todd Juenger wrote in a recent report.

Murdoch has spent 60 years building his company, which started with a daily newspaper in his native Australia. âI pretty much had one small newspaper and an overdeveloped ambition,â Murdoch told investors last month. The corporate logo for the publishing company is a handwritten âNews Corp.,â an amalgamation of Murdochâs handwriting and that of his late fatherâs, who also was a prominent Australian newspaper editor.

The companyâs split will probably shake up some of Murdochâs weaker newspapers, Mutter said. Those properties, he said, have relied on News Corp.âs deep pockets to prop them up amid sliding circulation and advertising revenue.

âFor years, Murdochâs papers were somewhat immune from the market forces, but now they wonât be,â Mutter said. âNow all of the News Corp. papers will have to stand on their own two feet. They will have to live within their means.â

News Corp. has said it plans to record a pre-tax non-cash charge of $1.2 billion to $1.4 billion at the end of the current fiscal quarter to account for the lower value of some of its publishing assets.

Just this week, two of Murdochâs money-losing newspapers â the New York Post and the Times of London â began shedding staff. Both properties are said to be losing money.

More to Read

From the Oscars to the Emmys.

Get the Envelope newsletter for exclusive awards season coverage, behind-the-scenes stories from the Envelope podcast and columnist Glenn Whippâs must-read analysis.

You may occasionally receive promotional content from the Los Angeles Times.