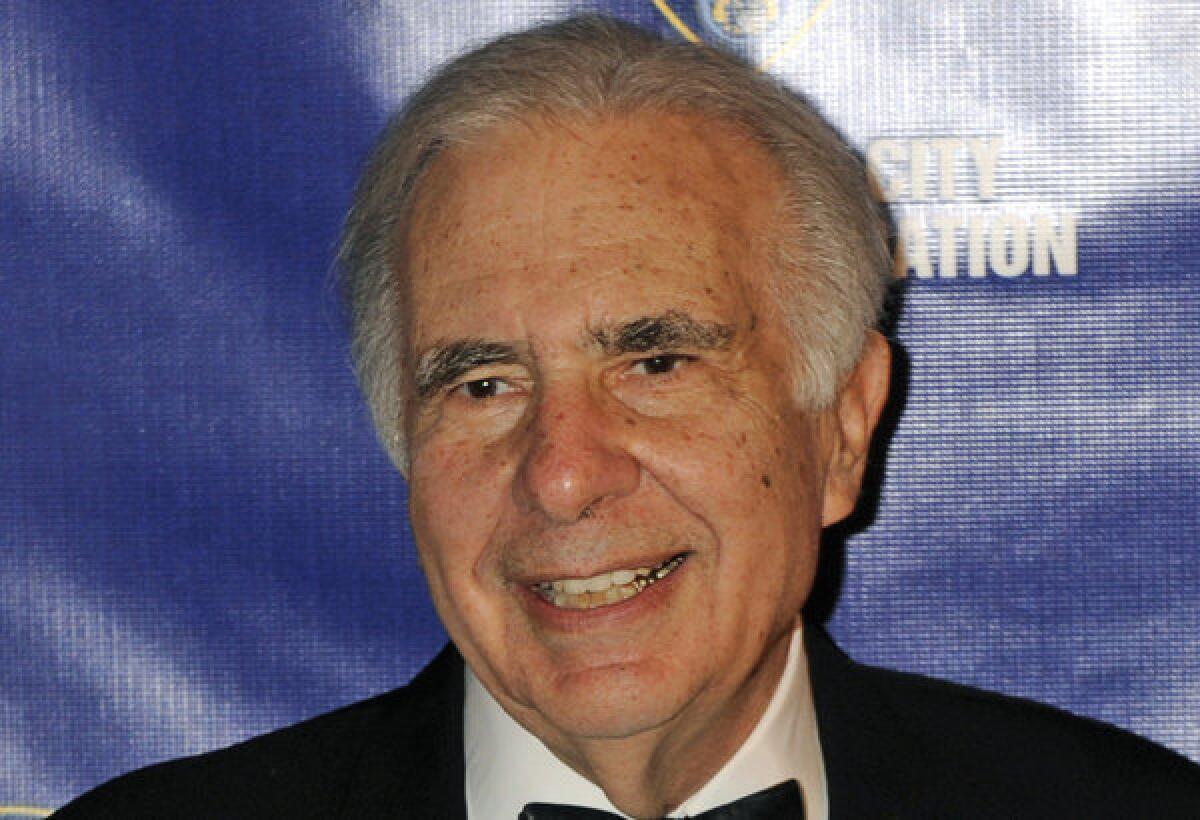

Activist investor Carl Icahn sells Netflix shares

Activist investor Carl Icahn said he sold nearly 3 million shares in Netflix, noting he reaped a substantial windfall from his investment in the online video service.

Icahn said he decided it was time to cash out, after the rapid appreciation of the companyâs stock, which rose to $323 a share, from his initial investment of $58 a share.

âAs a veteran of seven bear markets, I have learned that when you are lucky and/or smart enough to have made a total return of 457% in only 14 months, it is time to take some chips off the table,â Icahn said in a statement.

After the sale, Icahn retains a stake of 4.5%, with nearly 2.7 million shares.

ON LOCATION: Where the cameras roll

Son Brett Icahn and a manager at Icahn Enterprises, David Schechter, issued a statement saying they felt the company remains âsignificantly undervalued.â

âAs a subscription service priced at only $7.99 per month, we believe Netflix is one of the great consumer bargains of our time,â Schechter and Brett Icahn wrote. âWe find it difficult to understand why a household would not subscribe to the service.â

The younger Icahn and Schechter wrote that they share Netflix Chief Executive Reed Hastingsâ vision that the company could eventually reach 60 million to 90 million domestic subscribers. They estimate that with these subscriber additions -- and the âreasonableâ prospect of an eventual price hike to $10 a month over the next five years -- the company would raise its domestic streaming revenue by $4.3 billion a year.

While the domestic growth story is compelling, they wrote, the international opportunity is even larger.

âAs these international markets mature, we expect the aggregate international operating profits will actually exceed the domestic,â Brett Icahn and Schechter wrote.

PHOTOS: Hollywood Backlot moments

Netflix stock closed at $322.47 Tuesday, down 9% for the day. The stock had rallied in after-hours trading Monday, after the company reported earnings of $32 million, or 52 cents a share, for the three months ended Sept. 30. Thatâs four times its earnings from the same quarter last year. Revenue reached $1.1 billion, up 22% from the same period in 2012.

Some analysts raised questions about the serviceâs âlow-quality promotionsâ in Latin America, and how it could affect profitability. Others noted the paltry $7 million in free cash.

Chief Financial Officer David Wells told investors the company is changing how it validates subscribers for its free trials.

âYouâve got a lot of people in a free trial state that arenât going to become paid subscribers,â Well said Monday, during a Google hangout with investors to discuss the companyâs third quarter. âYou crack down on that and you run the risk of blocking a few people that are going to be paid subscribers.â

[For the record, 5:50 p.m. PDT Oct. 22: An earlier version of this post said Netflixâs domestic streaming revenue was estimated to reach $4.3 billion a year. It was estimated to grow by that amount.]

ALSO:

Carl Icahn takes 10% stake in Netflix

Netflixâs Open connect is a touchy issue for big cable

Netflix earnings jump as it surpasses HBO in U.S. subscribers

More to Read

From the Oscars to the Emmys.

Get the Envelope newsletter for exclusive awards season coverage, behind-the-scenes stories from the Envelope podcast and columnist Glenn Whippâs must-read analysis.

You may occasionally receive promotional content from the Los Angeles Times.