Snapchat makerâs first earnings report since IPO could reveal how much user growth matters to investors

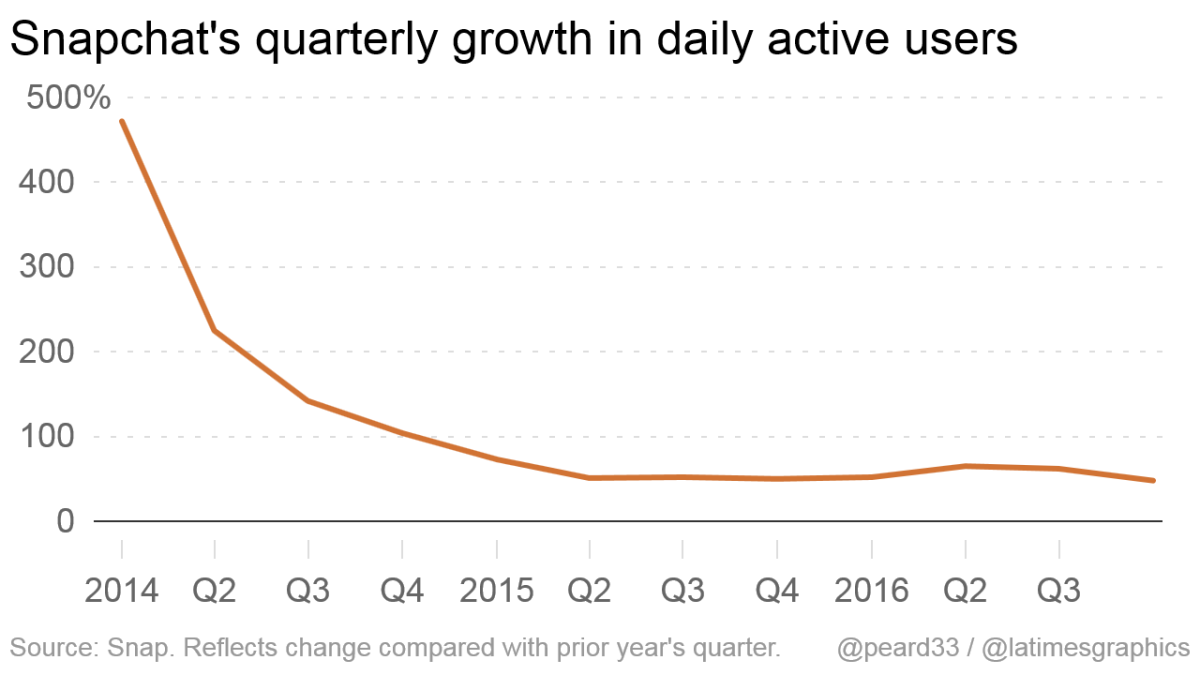

But whether the usage growth is sizable enough to satisfy investors is the biggest question looming over the young Los Angeles company ahead of its Wednesday announcement.

Chatting with friends and watching mini TV-shows on Snapchat shouldnât appeal to just the appâs core demographic of young users in developed countries â it should appeal to everyone, Snap Chief Executive

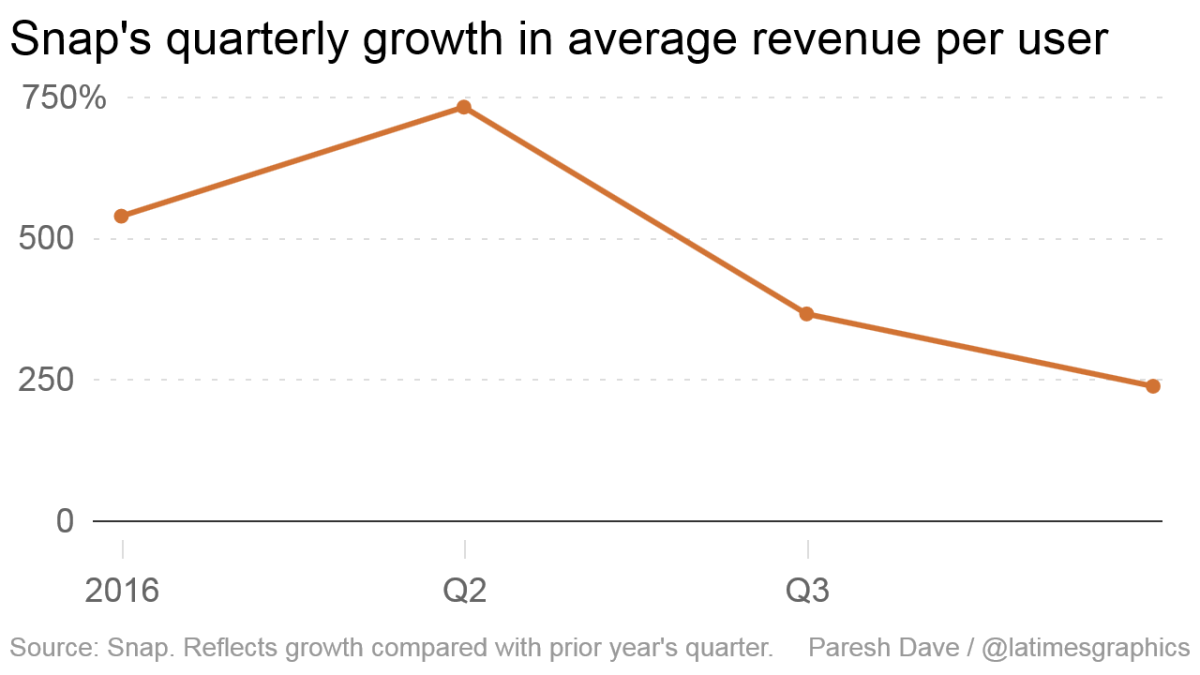

With 158 million daily users at the end of 2016, or 48% more than the end of 2015, Snap generated about $1.05 in ad sales per individual.

Revenue is expected to increase this year because Snap has a bigger ad sales team, new types of ads and more ways for people to buy ads. Brands as big as McDonaldâs and as small as independent wedding planners can pitch to Snapchat users through videos, animations and graphics.

Financial analysts at stock brokerages expect average revenue per user to double to $2.10 by the end of 2017 and reach five times as high during the following year.

Though investors do desire sales growth, theyâve been conditioned by Snapchat predecessors such as LinkedIn, Facebook and Twitter to pay greater attention to usage data. Keep the users coming, and there will be boundless ways to make money off them, the thinking goes.

To such investors, Snap may be worth only its current market capitalization of $27 billion if theyâre sure the company will reach 500 million users in the 2020s and eventually, like Facebook, more than 1 billion. And theyâre especially concerned about the growth in usage of Snapchat-inspired features on Facebook and its Instagram app.

Skeptical investors view Snap as Facebookâs free research lab, from which the Menlo Park social media giant can pick successful ideas and expand at Snapchatâs expense.

Snap has advised about âlumpyâ user growth, or quarterly variances, depending on what new features are introduced in Snapchat, William Blair financial analyst Ralph Schackart wrote in a report last week. The company also has avoided actions that could boost usage in new countries or among older consumers, saying it would rather focus on improving the experience for its core users.

âDespite this warning, we believe investors will still focus on quarterly [daily active users], especially with the rate at which Facebook continues to roll out features on its properties that are similar to features Snap offers,â Schackart said.

He estimated Snap on Wednesday would announce 169 million users, up 39% from last yearâs first quarter.

Snap's first quarter: Consensus predictions from analysts

- $158 million in sales

- $2 billion in losses, largely from IPO expenses

- $1.92 loss per share

Source: FactSet

Demand for Snap shares could be limited until more investors buy into the companyâs message, especially if user growth is lackluster. Financial analysts say the anxiety is already reflected in Snap shares, which closed Monday at $22.46, below the companyâs March 2 debut of $24.

Investors who agree with Snapâs viewpoint say that Snapchat could surpass Facebook in average revenue per user and be profitable without ever having as many users. Only a consistent decline in users would force them to rethink their bet.

âThis is the microbrewery, not the giant

Shifting focus away from usage growth from the beginning could benefit Snap.

Online radio service Pandora Media spent many of its initial post-IPO earnings announcements heralding statistics such as active listeners and total listening hours. The data gave the company, which went public in 2011, a scare in 2014 when shares were clipped in half from an all-time high after user growth failed to meet expectations.

After touting growth potential to investors, Twitter likewise tumbled in its first four earnings reports as shareholders zeroed in on disappointing usage data. Pushing other measurements has been difficult for Twitter co-founder Jack Dorsey, who returned to the chief executive role in 2015.

Snap is concentrating on developing features and ads for the worldâs top 10 advertising markets. Given Snapchatâs high saturation in those countries already, the company sees average revenue per user as a better signal of its performance.

Still, financial analysts say scrutinizing the number of advertisers and their spending would be even more beneficial than average revenue per user. ARPU, as itâs referred to in shorthand, makes sense for subscription companies. But in the first years of this century, media technology companies including Yahoo started using the metric as much as telecommunications firms such as Qwest.

For a company such as Snap, ARPU is akin to valuing a newspaper based on how many words it prints in a given year, said Pivotal Research stock analyst Brian Wieser.

âIt might coincidentally turn out to be relevant,â he said. But a better indicator would be what percentage of their budget the biggest advertisers are committing to Snapchat.

Questions about the latest deals with advertisers could come up when Spiegel and other executives address analysts Wednesday afternoon. How Snapchat views the competition from Facebook and whether it has rectified technical issues with its app for Android smartphones may come up too, said Christos Charalambous, senior strategist at Snap shareholder Edge Wealth Management.

In the early stage of its growth cycle, Snap is not going to perfectly deliver on everything, Charalambous said. âBut if the ARPU is growing, you give them the benefit of the doubt.â

UFC entrepreneurs on the hunt for tech start-ups

The brothers who turned the mixed-martial arts sports organization UFC into a global force are starting an investment fund based in West Hollywood.

Lorenzo and Frank Fertitta sold UFC for $4 billion to talent agency WME | IMG last year. Frank Fertitta still runs casino operator Red Rock Resorts. But his brother will be running the new fund, which plans to invest a few million dollars to potentially $100 million in entertainment, technology and media companies. That includes sports, e-sports, hospitality and food and beverage.

Sam Bakhshandehpour, former CEO of hotel and club company SBE Entertainment and a longtime investment banker at J.P. Morgan, is Fertitta Capitalâs managing director.

Bakhshandehpour, who left SBE two years ago, said he joined Fertitta to reunite with the firmâs CEO, Nakisa Bidarian. Theyâd grown close since working on a deal together a decade ago.

Bakhshandehpour said the plan is to focus on consumer products and services developed in the U.S. The team would invest in recently launched start-ups seeking a few million dollars in cashas well as in more established companies looking for a much bigger check for international expansion.

âWeâre looking to be opportunistic,â Bakhshandehpour said. âYou donât want to box yourself in.â

They can afford the flexibility because the Fertittas arenât wedded to generating returns in a specific time frame. They plan to invest through ups-and-downs in the economic climate and select companies that can sustain themselves through declines in consumer spending.

Bakhshandehpour said he and the Fertittas have made personal investments on the side prior to launching the fund, but he declined to disclose them.

Azubu lays off technology team as it doubles down in Europe

Azubu, a video-streaming service aimed at e-sports enthusiasts, laid off eight people last week as it winds down technology development at its Sherman Oaks headquarters, its CEO said.

The company languished for several years under the strange financing scheme of its primary investor, who supplied cash in monthly installments that were regularly late and insufficient.

Azubu acquired rival Hitbox at the end of last year with plans to focus on broadcasting European video game competitions and move past the money woes. Now combined, the companies expect to launch this week under the name Smashcast. The redesigned service will introduce commenting and broadcasting features that bring it more in line with leaders such as Facebook Live and Twitch.

âAs we solidified a new platform, it was time to determine how do we want to support that,â CEO Mike McGarvey said in explaining the layoffs.

About 12 people remain in Sherman Oaks. McGarvey, based in San Francisco, plans to hire more staff there and in Vienna, where Hitbox was founded.

âItâs refereshing that thereâs passion and effectiveness out of Vienna that was missingâ at Azubu, he said.

Whether gaming companies and investors want to partner with Smashcast given its checkered history is to be seen.

Cybersecurity start-up Signal Sciences gets $15-million investment

Signal Sciences, a Venice company developing tools to keep hackers from breaching online apps, received a $15-million investment led by Charles River Ventures.

Since launching a year ago, Signal Sciences has signed up about 60 paying customers such as Yelp, Under Armour and WeWork, Chief Executive Andrew Peterson said. The start-up also opened an office in nearby Santa Monica.

Itâs now working to make its service compatible with a greater number of technologies, which should lead to a wave of new customers this year.

Peterson said the biggest validation that Signal Sciences is headed in the right direction is that cybersecurity companies including Duo and Tenable, which offer different services, are among its users. Signal Sciencesâ competition includes Imperva and Akamai.

Elsewhere on the Web

- Businesses focused on products and services for babies are drawing big interest from entrepreneurs and investors, according to Crunchbase.

- Chipmaker Nvidia led a $1.5-million financing of Santa Monica start-up Fastdata.io, which is developing software to make computers faster, according to VentureBeat.

- The Los Angeles tech artery of Lincoln Boulevard could get a makeover, according to L.A. Magazine.

- Car-sharing company Turo received a warning from Los Angeles city officials about taking advantage of curbside parking spots as part of a business, according to L.A. Business Journal.

In case you missed it

- After a meeting with Google co-founder Larry Page, Soylent picked up a $50-million investment from his companyâs venture capital arm.

- An attorney for San Bernardino terrorism victims is taking on social media apps for harboring extremists. Does he stand a chance?

- In Silicon Valley, even mobile homes are getting too pricey for longtime residents.

Coming up

Twitter: @peard33