Qualcomm unveils âdigital chassisâ tech at CES as it diversifies beyond smartphones

Qualcomm has opened the hood on its âdigital chassisâ strategy at CES in Las Vegas, showcasing efforts to expand mobile technologies beyond smartphones and deeper into cars.

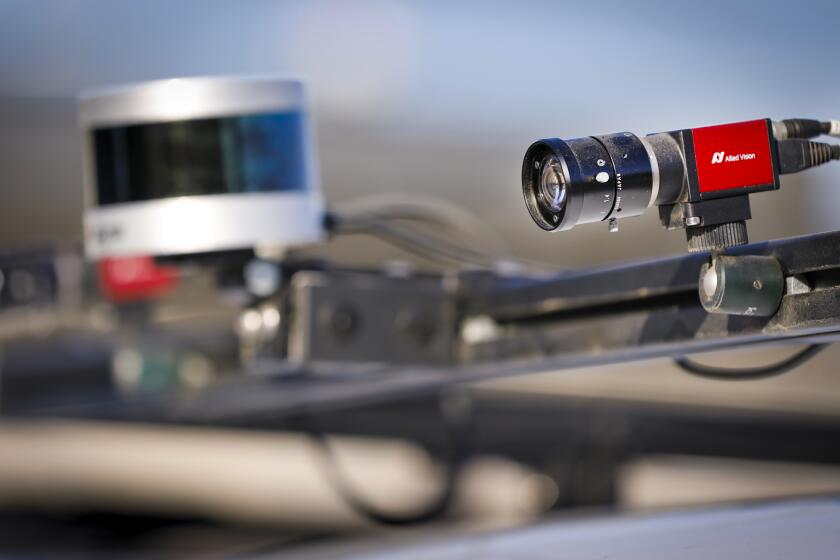

The moves include a new computer vision processor called the Snapdragon Ride Vision System, which the company says will deliver advanced driver assistance via onboard cameras beginning in 2024.

The San Diego firmâs new leading-edge chip will square off against Intelâs Mobileye, which currently dominates machine vision technology used in cars. Mobileye announced its own new chip at CES to help enable autonomous driving in partnership with Volkswagen and Ford.

Qualcomm also unveiled digital cockpit/infotainment deals with Volvo, Honda and Renault to bring onboard connectivity, high-tech dashboards and entertainment systems to vehicle models as soon as this year.

âWe are always going to be the company focused on mobile, but there is more to Qualcomm,â Chief Executive Cristiano Amon said at a Tuesday news conference at CES, previously known as the Consumer Electronics Show. âCar companies, many of them now, are tech companies. Technology assets have become extremely important.â

Automakers have embraced technology, not only to make vehicles safer but also to potentially enable new revenue streams, such as from subscriptions for onboard services.

Qualcommâs chip sales to automakers reached $1 billion last year â mostly from connectivity and infotainment systems. It forecasts auto revenue to climb to $3.5 billion annually in five years.

The biggest U.S. chipmakers, including Intel Corp., Nvidia Corp., Advanced Micro Devices Inc. and Qualcomm Inc., are starting off 2022 by unveiling products that push further into their rivalsâ main territories, signaling theyâre girding for tough competition as semiconductor demand increases across industries.

The company currently has a $13-billion order pipeline for automotive technology, including for 4G/5G, Bluetooth, Wi-Fi, vehicle-to-vehicle communications, audio, rear-seat video and digital dashboards â as well as advanced driver assistance systems (ADAS) and autonomous driving technologies.

BMW and General Motors are Qualcommâs main customers, but it sells to several other carmakers, including Audi, Chrysler, Hyundai and Lexus.

With the new Snapdragon Ride Vision System, Qualcomm isnât targeting full driverless capabilities, known as Level 4 autonomy, at least for now.

Instead, itâs steering toward driver assistance camera systems that help motorists without taking complete control. It aims to make the technology available across all vehicle price ranges, Amon said, from entry level to luxury.

âWhen we think about ADAS, we think the real opportunity is to attach Level 2 and Level 3 to every car,â Amon said. âIt can become as pervasive as anti-lock braking systems and airbags.

âWe are working on full autonomy as well,â he said. âWe know that has more regulatory challenges and needs more time to mature. But the opportunity to do Level 2 and Level 3 as an assisted solution to the driver is real and is one that can really scale.â

Last year, Qualcomm joined with private firm SW Partners to acquire Swedish auto technology firm Veoneer for $4.5 billion. The complex deal calls for Qualcomm to retain Veoneerâs Arriver autonomous driving software stack, while SW Partners will sell off the rest of Veoneerâs remaining auto sensor businesses.

Arriver software is included in the Snapdragon Ride Vision System.

They collect user data for their own ends, but when it comes to allowing crash data to be used to improve safety, these companies push for less transparency.

With Volvo, Qualcomm inked a deal to supply Snapdragon Cockpit technologies in upcoming fully electric SUVs.

The first vehicles are slated to hit the market later this year. Working with Googleâs Android automotive operating system, the SUVs will feature hands-free help from Google Assistant and navigation with Google Maps, among other things.

Honda will begin using Qualcommâs chips in models expected to be available in the second half of this year in the U.S. and globally in 2023.

Renault Group also plans to plug in Qualcommâs technologies but didnât reveal when vehicles would be available.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production â and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.