Column: Trump’s tax cuts aren’t enough to address the crisis. We need a viral New Deal

The continuing spread of the novel coronavirus raises two interrelated questions about America’s ability to deal with the unfolding crisis. First, can it manage the public health ramifications of the event? Second, can it manage the economic turmoil?

The answer to the first is still unknown, since the country’s public health infrastructure is still in the hands of manifestly incompetent leadership in Washington, D.C. The answer to the second, however, is a resounding yes. But that, too, is dependent on political will in Washington.

The government has more than enough fiscal capacity to provide assistance to American workers and their families, and to state governments that are on the economic frontlines. Indeed, falling interest rates in the bond markets have given the government even more capacity. The government also has the legal and administrative tools to deliver this assistance.

The economy is going to suffer mightily over the next couple of months, at least, but policymakers are not impotent.

— Ian Shepherdson, Pantheon Macroeconomics

This can happen either through direct payments — “helicopter money,” the late economist Milton Friedman called it, evoking the image of greenbacks being dropped from the sky — or through automatic economic stabilizers such as food stamps and unemployment benefits.

Either way, this would encourage people to stay at home to avoid spreading infection, would keep them solvent while away from work, and shore up our consumer-driven economy.

This low-interest debt would help state governments pay the costs of their public health initiatives, which could include widespread virus screening and the treatment of low-income Medicaid patients found to be infected.

In the longer term, low-interest federal borrowing could also finance physical infrastructure building and rebuilding. That’s a project that President Trump has been dangling in front of voters since his inauguration, but has never put into practice. It’s time.

It isn’t just liberals or Democrats who are urging aggressive fiscal stimulus. Gary Cohn, a former Goldman Sachs executive and former economic advisor to President Trump, weighed in over the weekend via Twitter.

Cohn suggested that fiscal stimulus be targeted at gig workers and employees in the service sector — “cinemas, airlines, taxis — that aren’t getting paid or who have lost jobs.” He also argued, quite properly, that the government should make sure that “small businesses have access to financial support to survive the short-term consumer withdrawal from the economy since it is harder for them to weather times like this.”

Democrats in Congress have begun working on several initiatives, including augmenting unemployment insurance, enacting a mandate for paid sick leave, and assisting industries especially hard-hit by the crisis, such as travel and lodging companies. The administration’s position on these or any other proposals is unclear, though Trump has talked about help for the hospitality industry.

“The economy is going to suffer mightily over the next couple of months, at least,” observes Ian Shepherdson, chief economist at Pantheon Macroeconomics, “but policymakers are not impotent.”

Let’s see how all this works.

A few facts stand out clearly amid the murk of the virus’ course and the economic reaction. One is that the ability of the Federal Reserve to address the crisis is limited — in fact, it may already have reached its limits.

By limiting sick leave and free healthcare, the U.S. system will promote the spread of coronavirus.

The Fed cut short-term interest rates by a half-percentage point on March 3. The cut had little discernible effect on stock traders, who were its chief target. Even so, another rate cut is anticipated, perhaps by the end of this month.

After that, the Fed’s arsenal is tapped out, since it can’t cut rates to less than 0% (at least, not directly). But that points to another opportunity: Instead of monetary stimulus, which is what the Fed does, fiscal stimulus. That’s what Congress and the president do.

In short: spending money. Normally, government has a choice of financing fiscal stimulus by borrowing or raising taxes. This time around, the choice is taken out of their hands. Interest rates for government bonds are at historic lows, with the yield on the benchmark 10-year T-bond declining below 0.4%. The government should take advantage of this unprecedented moment to borrow like mad.

Then the question is what should it do with the money?

That points to another indisputable fact: In the short and medium term, rank-and-file workers and their families are going to need massive help to get through this crisis.

Some employers will send their workers home to reduce exposure to the novel coronavirus in their workplaces, but many people have jobs that can’t be performed remotely. As we’ve reported, they’ll either keep going to work or stay home and miss paychecks. Some businesses will entirely shut down, whether temporarily or permanently, because their customers have disappeared.

The first imperative to address this issue is to make sure that the government’s automatic economic stabilizers are strengthened and expanded. These programs include food stamps (the Supplemental Nutrition Assistance Program, or SNAP) and unemployment insurance.

Trump’s latest attack on food stamp recipients will throw 700,000 off the rolls — and more attacks are coming.

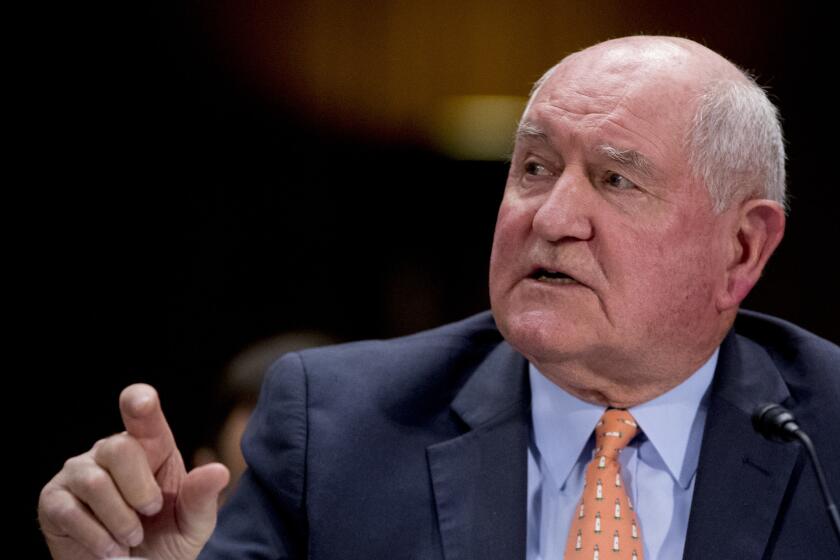

The Trump administration and its Republican enablers in the Senate have been aiming to cut eligibility for food stamps. Trump’s most recent so-called reform, proposed late last year, would have thrown 700,000 people off the food stamp rolls by forcing them to go through unduly burdensome paperwork. It should be obvious that this sort of approach should be shelved, preferably forever. The government should be prepared to extend the time limits for unemployment benefits, as it did in the aftermath of the 2008-09 recession.

The effect of helicopter money has often been debated by economists. It’s worth noting that Friedman, the conservative economist who provided the image, was in no doubt. He reckoned that recipients would spend the money rather than hoard it, especially if it was well-understood that it was a one-time event such as a working-class tax refund issued on tax day. Another option used by the Obama administration was a temporary payroll tax cut, enacted in 2010.

At a press conference Monday, President Trump mentioned a number of possible fiscal options, including a payroll tax cut, but gave no details. Some will be announced Tuesday, he said.

Those options wouldn’t help all workers forced out of their customary jobs and workplaces. Some aren’t eligible for unemployment benefits, including gig workers such as Uber and Lyft drivers.

If those drivers have to stay on the road to make ends meet, they could be especially vulnerable to infections contracted from passengers, and capable of spreading the infection to other passengers. The government needs to set up a program guaranteeing income to anyone quarantined because of the novel coronavirus.

Most developed countries offer guaranteed paid sick leave, and it’s obvious that this makes it easier to encourage sick people to stay home, and would allow parents to stay home to care for sick children or those forced to stay home by school closures. Nothing prevents the U.S. from imposing such a mandate, except our political immaturity.

States, counties and cities will face potentially budget-busting costs to test and screen residents. Medicaid is the best way to provide these services to low-income households.

Federal and state officials have few options to force insurers to cover COVID-19 for free.

The federal share of traditional Medicaid, however, ranges from 50% to 75%; for Medicaid expansion under the Affordable Care Act, which covers low-income childless enrollees, it’s 90%. The government should jump up its share of coronavirus-related services to 100%, taking over the cost from localities.

Quarantines carry a distinct downside to families with school-age children eligible for reduced or free school breakfasts and lunches. Because these meals typically are provided in schools, they’ll need to be delivered through other means if schools are closed to fight the virus’ spread, as already has happened in some systems across the country.

The School Nutrition Assn. has urged the Department of Agriculture to waive regulations interfering with meal deliveries in alternative settings such as libraries. Money should be made available to fund outreach and meal deliveries to families that can’t leave their homes at all.

Another challenge is to encourage people in our most vulnerable communities to come forward for testing and treatment, if needed.

They’re often immigrants, documented and otherwise, who have been forced underground by the Trump administration’s “public charge” rule, which threatens them with penalties up to and including deportation if they’re found to have enrolled in public assistance programs such as Medicaid. Trump needs to state forthrightly and explicitly that the public charge rule is null and void.

These options are direct investments in blocking the spread of an infectious disease. Like all good investments, they’ll yield dividends, starting in the short term. In the longer term, the prospect of an economic emergency and the rock-bottom cost of addressing it should finally be enough to get Congress and the White House to create a substantial infrastructure construction program.

The money is available and the rationale is inescapable. Is anyone in Washington listening?

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.