Around the world, luxury housing is poised to (mostly) strengthen

Around the world, many rich home buyers lay low in 2019 as economic uncertainties turned some cities into risky propositions.

But don’t be surprised in 2020 to spot the world’s wealthiest people beginning to spend again as home prices in relatively stable areas continue to sink into bargain territory.

In a few cities, prices are even set to rise, according to global property consultancy Knight Frank.

Paris leads the agency’s 2020 forecast, with a 7% luxury price increase, followed by Miami and Berlin, where luxury units are relatively affordable and in short supply.

Political and economic questions still abound, including trade wars and November’s U.S. presidential election. And taxes on the rich instituted by cities such as Vancouver, London and New York will continue to weigh on sales, said Kate Everett-Allen, a Knight Frank partner in London.

‚ÄúMost markets will still see prime prices increase but by smaller margins than previously,‚ÄĚ she said.

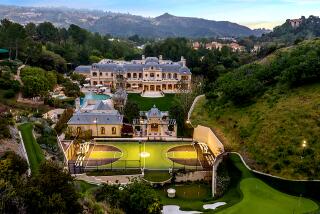

Los Angeles’ bright spot is in the $2-million to $10-million range

Los Angeles‚Äô luxury market is expected to show moderate price increases in 2020 ‚ÄĒ amounting to about 2%.

It might have been higher but for a pullback of foreign buyers, particularly Chinese citizens who face restrictions on moving money abroad. That’s tended to weaken the highest end of the market.

California’s wildfires, including one in 2018 that tore through Malibu, also have hurt by pushing up the cost of insurance, according to Philip White, chief executive of Sotheby’s International Realty.

Despite some huge deals in 2019, demand has been particularly weak for properties above $10 million. Homes priced below $10 million have a more bullish outlook, according to Knight Frank.

‚ÄúL.A., at present, is more of a domestic market,‚ÄĚ White said.

New York is still a buyer’s market

New York City prices are expected to fall 3% next year, a continuation of 2019’s trend. To sell all the newly built condos in Manhattan at the current sales pace, it would take nine years. And the uncertainty of the presidential election will likely keep buyers on the sidelines, said Jonathan Miller, president of appraiser Miller Samuel Inc.

Demand has also slipped because real estate investors have fled the market, spooked by a legislative environment that’s targeted them via more onerous rent regulations and an increased mansion tax, which leaves buyers of luxury property with higher closing costs.

‚ÄúThe luxury market on the sales side is the weakest segment of the housing market,‚ÄĚ Miller said.

Without foreigners, Vancouver’s stuck too

Sellers of pricey properties in Vancouver in 2020 will likely still be feeling the hangover from the pullback of Chinese buyers and foreign buyer tax measures that were introduced in 2016 to cool runaway prices. Luxury values in the city will fall 5% this year, according to Knight Frank’s forecast.

On the positive side, there’s a new opportunity for domestic buyers, said Kevin Skipworth, partner and managing broker with Dexter Realty in Vancouver.

‚ÄúThe government has put properties on sale for those who otherwise couldn‚Äôt afford it,‚ÄĚ he said, meaning that the tax has effectively made high-end properties cheaper for locals.

Hong Kong will deflate

The political unrest in Hong Kong has hurt the luxury market, but it’s still unlikely to crash in 2020, according to Knight Frank, which projects a 2% drop for luxury prices next year.

Sotheby’s White said buyers are putting purchases on hold while they watch to see what happens with the pro-democracy protests. In the meantime, they’re starting to look for opportunities elsewhere in cities such as in Los Angeles, San Francisco and London.

‚ÄúReal estate buyers look for a stable political system, and they‚Äôre not finding that right now in Hong Kong,‚ÄĚ he said.

Miami will have a comeback

Miami’s high-end condo market is poised for a comeback in 2020, helped by President Trump’s tax overhaul, which capped federal deductions on state and local taxes, according to Knight Frank.

While South Americans pulled away in recent years as the strengthening dollar added to the cost of buying in the U.S., domestic buyers are making up for it: Florida, which has no income tax, is drawing wealthy buyers from high-tax states like New York and New Jersey. Those buyers will push up Miami high-end prices by 5% in 2020, Knight Frank said.

Central London will have modest success

Central London, where prices fell 3% in the 12 months through November, will stabilize slightly next year as the fate of Brexit becomes clearer, said Tom Bill, Knight Frank’s head of London residential research. Prices are likely to rise by about 1% in 2020, according to Knight Frank research, now that Conservatives have won in a landslide.

‚ÄúOnce the Brexit deal is completed, we forecast rising momentum across all markets, with price growth reflecting this from 2021 onwards,‚ÄĚ the company‚Äôs 2020 forecast report said.

The ratio of shoppers to available listings reached a decade high in September, a sign of rising demand. The decline in the British pound combined with years of decreases in property prices are attracting foreign buyers again, Bill said. ‚ÄúNext year we could see the disorderly Brexit risk recede,‚ÄĚ he said. ‚ÄúIf that is the case, there‚Äôs an awful lot of pent-up capital ready to buy in London, and that will translate into higher levels of activity.‚ÄĚ

Gopal writes for Bloomberg.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.