Downtown L.A. landlord Brookfield sees office market rising steadily

The office rental market in downtown Los Angeles has been stagnant for decades, but New York real estate firm Brookfield Office Properties Inc. is betting millions of dollars that it will improve in the years ahead.

Chief Executive Dennis Friedrich talked up downtown Los Angeles in a conference call with analysts Friday, a day after Brookfield announced plans to pay about $430 million for four large, prominent office buildings there.

âWe are being realistic about the downtown market,â he said. âItâs going to be a slow, steady improvement.â

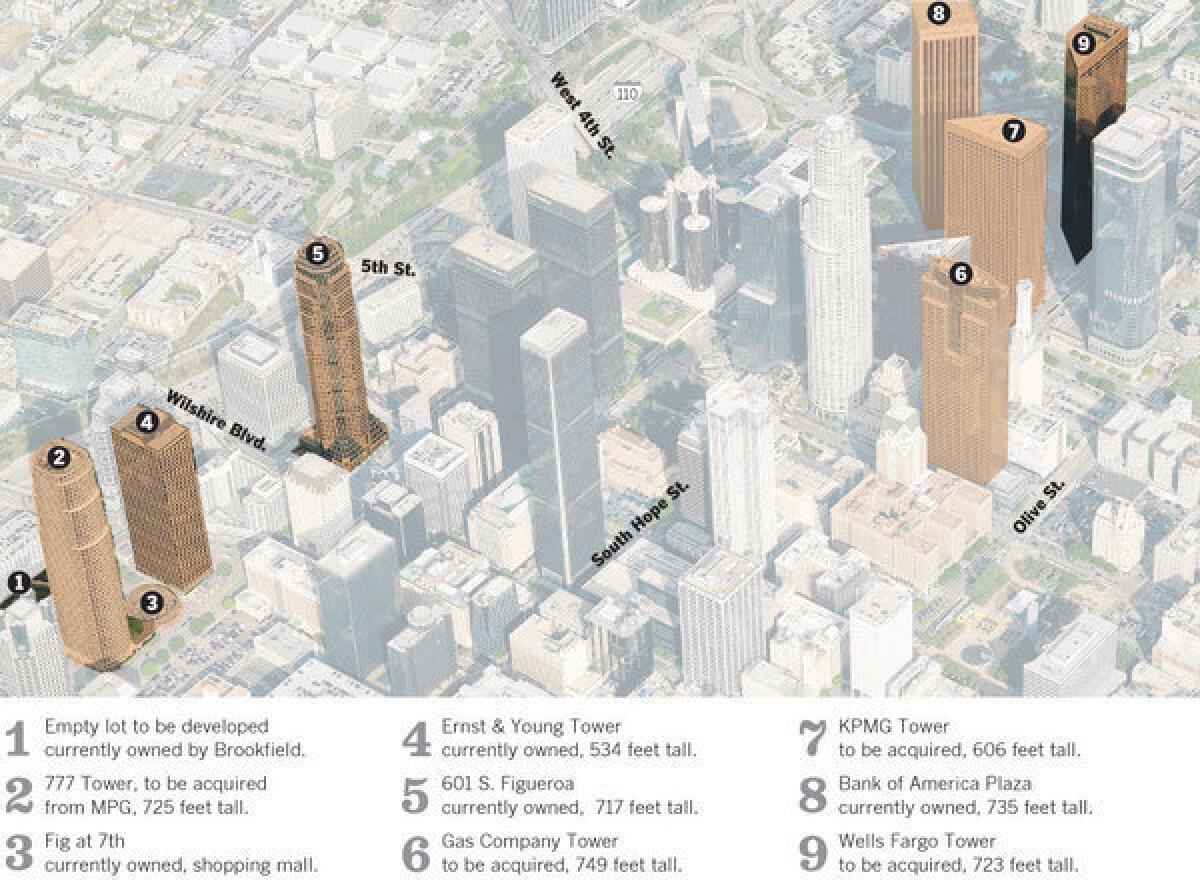

If the purchase is approved by shareholders of seller MPG Office Trust Inc., Brookfield would be the largest downtown office landlord, having 8.3 million square feet to rent in seven buildings.

Overall vacancy in the business district was 21% at the end of the first quarter, almost two percentage points higher than it was a year ago, according to real estate brokerage Cushman & Wakefield.

Brookfield owns $23 billion worth of office properties in some of the largest cities in the United States, Australia, Canada and the United Kingdom. Friedrich said the downtown L.A. office market will eventually catch up with others that are prospering.

PHOTOS: Five tallest buildings in Los Angeles

âAround the globe there has been a trend toward growth in urban centers, and L.A. is looking at this over time,â he said. âWe like the direction the market is heading and think it will be improving quarter over quarter.â

Friedrichâs comments came after Brookfield reported its first-quarter earnings. The company reported a profit of $275 million, or 48 cents a share, down from $352 million, or 62 cents, a year ago.

Revenue was down about 1% to $628 million. Shares closed up 14 cents at $18.08 on Friday.

ALSO:

New York firm soon to be downtown L.A.âs biggest landlord

U.S. Bank Tower sold to investors from Singapore

MPG Office Trust chief Nelson Rising resigns

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production â and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.