Trade group promises stricter scrutiny of payday loan ads

A trade group for online payday lenders has started to comb the Internet for sites making misleading claims, part of an effort to clean up the reputation of an industry beset by complaints from consumer groups and regulators.

The Online Lenders Alliance, which represents short-term lenders and the companies that steer customers to them, started the new monitoring project after The Times reported in May that many websites advertising online loans say customers are not subject to a credit check ‚Äď a claim that‚Äôs usually not accurate.

Last month, OLA hired an outside firm to build a program that will search the Web for sites using the term ‚Äúno credit check.‚ÄĚ The group is now picking out sites that are controlled by lenders or loan advertisers and asking them to take down any ‚Äúno credit check‚ÄĚ claims and fix other problems.

OLA Chief Executive Lisa McGreevy said the group has done similar monitoring work before, but only manually ‚Äď typing various terms into Web searches, browsing sites and looking for misleading language or other bad practices.

This is the first time that the group has tried a more systematic approach.

‚ÄúWe‚Äôre trying to be the cop on the beat,‚ÄĚ McGreevy said. ‚ÄúWe‚Äôre not interested in having bad actors or people who do fraudulent business giving our good lenders a bad name.‚ÄĚ

The Times story that sparked the move focused on a lawsuit that illustrated increased regulatory interest in the online and payday lending industries, as well as the potential consequences for lenders or advertisers that make misleading claims.

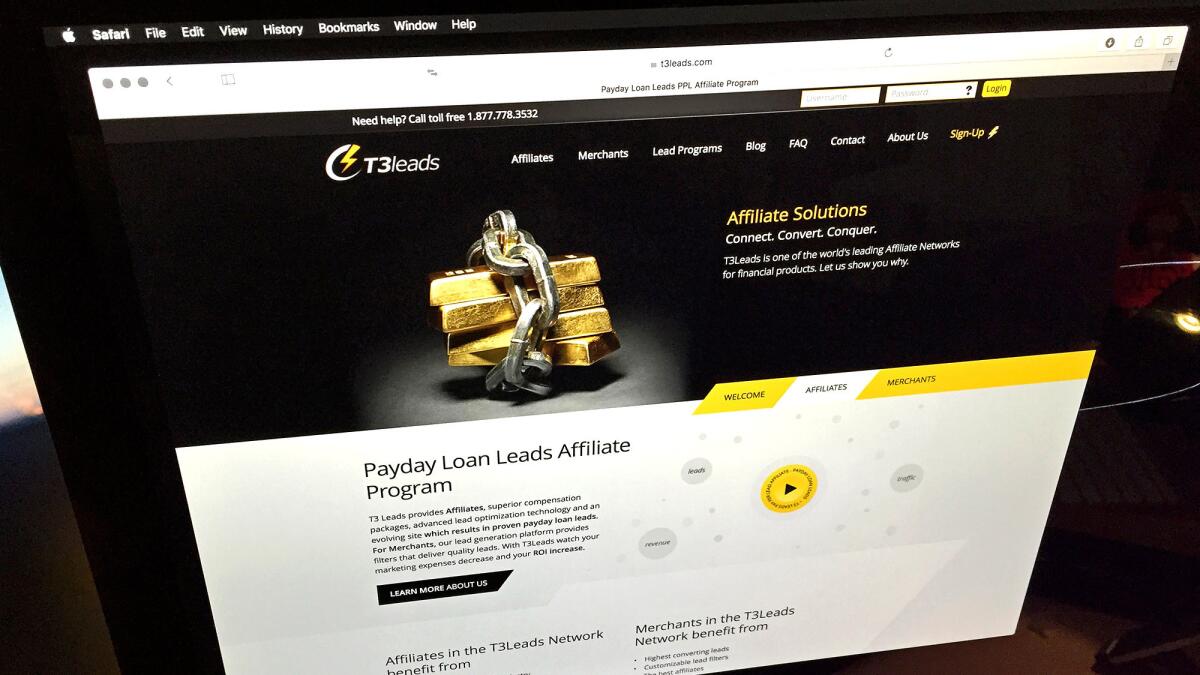

In December, the federal Consumer Financial Protection Bureau sued T3Leads, a Burbank broker that sells consumer loan inquiries to online lenders.

The bureau alleged in the suit that T3Leads does not properly monitor claims made by lead generators ‚Äď sites that collect information from consumers looking for loans.

The suit focused on advertisers‚Äô claims about loan rates and terms, which the bureau said can lure customers into bad deals. But McGreevy said that ‚Äúno credit check‚ÄĚ claims are almost never true and that sites that make them are helping perpetuate the notion that the industry is dishonest.

Though online payday lenders generally don‚Äôt pull a full credit report from one of the major credit bureaus, they will typically use other methods that qualify as a credit check, McGreevy said, making any ‚Äúno credit check‚ÄĚ claims misleading.

We’re trying to be the cop on the beat. We’re not interested in having bad actors or people who do fraudulent business giving our good lenders a bad name.

— OLA Chief Executive Lisa McGreevy

What’s more, sites making that claim are likely to have other problems as well.

‚ÄúWhen sites have one thing wrong, they probably have other things that are noncompliant,‚ÄĚ McGreevy said.

Much of this monitoring, she acknowledged, is work that lenders should already be doing. It’s up to lenders, she said, to make sure they’re buying customer information from companies that follow the rules.

But McGreevy said it’s difficult to stay ahead of sites that can change from one minute to the next.

‚ÄúStaying on top of it is a constant monitoring challenge,‚ÄĚ she said. ‚ÄúIt takes every part of our industry to look at what‚Äôs happening.‚ÄĚ

Once the trade group identifies a site making a ‚Äúno credit check‚ÄĚ claim, she said OLA will look for other language or site elements that go against the group‚Äôs rules. For instance, she said sites that require customers to agree to something often include a check box, but that shady sites will sometimes check boxes automatically.

When the group finds a site with problems, McGreevy said OLA will send the site‚Äôs operators a notice, asking them to fix problems ‚Äď or else. That goes for OLA members and nonmembers alike, she said.

‚ÄúWhenever I find someone who is a bad actor, I will report them to our members and to law enforcement and to regulators so they cannot perpetrate their fraud,‚ÄĚ she said.

Members who don‚Äôt bring their sites into compliance could be kicked out of the group, she said, while nonmembers could lose business. If OLA believes that a loan advertising site isn‚Äôt following the rules, the group‚Äôs members ‚Äď including lenders and lead brokers, such as T3Leads ‚Äď are not supposed to buy customer information from those sites.

If they do, it could lead to those lenders being booted from the trade group or regulatory headaches such as the kind of lawsuit now facing T3Leads.

OLA estimates its members account for about 80% of the nation’s small-dollar online lending volume.

OLA is starting out by looking for ‚Äúno credit check‚ÄĚ claims, but McGreevy said she plans to continue the monitoring program and eventually look for other misleading language.

Aaron Rieke of consulting firm Upturn, which issued a report last year that criticized the way that loan lead generators do business, said he’s encouraged to see OLA taking a step toward stricter enforcement of its policies, though it’s hard to know how effective the group’s efforts will be.

‚ÄúAnything they can do to be more proactive in policing misrepresentation is helpful,‚ÄĚ he said. ‚ÄúBut how many bad actors are going to respond to OLA‚Äôs inquiries?‚ÄĚ

ALSO

BBCN and Wilshire shareholders approve Koreatown bank merger

Venture capital deals slow amid doubts about augmented reality’s reach

Drivers win $5-million settlement in latest victory against trucking companies

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production ‚ÄĒ and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.