Reporting from Washington ‚ÄĒ Between the shutdown of oil refineries and chemical plants, impaired roads and ports, and widespread damage to homes, businesses and cars, the economic toll from Hurricane Harvey is now being estimated as the second-costliest natural disaster in U.S. history, trailing only the devastation caused by Hurricane Katrina in 2005.

Some economic researchers, including the national forecasting firm Moody’s Analytics, are putting the price tag of Harvey at $81 billion to $108 billion or more, most of that in damage to homes and commercial property.

That would be larger than the hit from Hurricane Sandy in 2012 but less than Katrina, which inflicted $175 billion in damage and lost economic activity. By comparison, the economic loss from the Northridge earthquake in 1994 came to about $45 billion, in inflation-adjusted dollars, according to Moody’s.

Although the brunt of Harvey’s cost will be borne in southeast Texas, particularly the sprawling Houston area, the effects will be felt more broadly.

Motorists across the country can expect to pay more for gas, at least for a while, and consumer spending overall could fall a bit as well. U.S. exports could see a slight drop from the temporary closure of one of the nation’s busiest ports.

All in all, Harvey is likely to sap some momentum from the American economy, which went into the summer chugging along in its ninth year of expansion.

The nation’s gross domestic product, or economic output, grew at a solid 3% annual rate in the second quarter, and projections for the current quarter have been looking as good. But depending on the degree and duration of impact, Harvey could shave 0.3 to 1.3 percentage points from third-quarter gross domestic product growth, according to Macroeconomic Advisers, a major forecasting firm based in St. Louis.

Some of that storm-induced drop is likely to be recouped later in the year as construction and repairs get rolling, largely funded by government dollars.

Neither Macroeconomic Advisers nor other economists have made significant revisions to their growth forecasts for the full year after Harvey. Most still expect GDP to expand at about a 2.5% rate in 2017, a somewhat faster pace than the average, moderate growth rate of around 2% in recent years.

And no one is expecting anything more than a blip on national employment from Harvey, and no affect at all on the jobs report for August that is being released Friday.

1/87

Samir Novruzov wades through water to get to a vehicle after spending the day clearing out his flooded home in Katy, Texas.

(Marcus Yam / Los Angeles Times) 2/87

Melissa Teague, right, instructs her children Andrew and Emily as they clear out their flooded home in Katy, Texas, on Monday.

(Marcus Yam / Los Angeles Times) 3/87

People ride through floodwaters in Katy, Texas.

(Marcus Yam / Los Angeles Times) 4/87

People hop off Chris Ginter’s truck as he helps ferry residents around Katy, Texas.

(Marcus Yam / Los Angeles Times) 5/87

Two men collect a disposed mattress as residents in the Trinity/Houston Garden area of northeast Houston gut their flooded homes.

(Robert Gauthier / Los Angeles Times) 6/87

Wayne Christopher, center, weeps as his wife, Helen, looks on during a Sunday service at First United Methodist Church in Dickinson, Texas.

(Marcus Yam / Los Angeles Times) 7/87

Hurricane Harvey severely damaged the First Baptist Church in Rockport, Texas. Worshipers on Sunday brought their own chairs to take part in an outdoor service.

(Robert Gauthier / Los Angeles Times) 8/87

Ken Garrett, right, hugs Pastor Jordan Mims after they both delivered prayers on the grounds of the First Baptist Church in Rockport, Texas.

(Robert Gauthier / Los Angeles Times) 9/87

University of Houston law professor Johnny Buckles props up an American flag on the debris pile from his flood-damaged home in the Kingwood area of north Houston.

(Robert Gauthier / Los Angeles Times) 10/87

Jose Esquivel flags down motorists to visit a parking lot full of donated clothes, supples, water and brisket in Refugio, Texas.

(Robert Gauthier / Los Angeles Times) 11/87

Despite heavy damage and no electricity, a homeowner displays his patriotism while clean up and recovery efforts continue in his devastated neighborhood of Rockport.

(Robert Gauthier / Los Angeles Times) 12/87

Volunteers from the Ahmadiyya Muslim Youth Association, Yusuf Seager, from left, Rahib Ahmed, Rahman Nasir, and Khalil Nasir help tear out drywall damaged by floodwater in the Westbury neighborhood in Houston.

(Marcus Yam / Los Angeles Times) 13/87

Volunteers from the Ahmadiyya Muslim Youth Association help residents of the Westbury neighborhood in Houston clear debris from their homes. It is also the Islamic holiday of Eid-ul-Adha. (Marcus Yam / Los Angeles Times)

(Marcus Yam / Los Angeles Times) 14/87

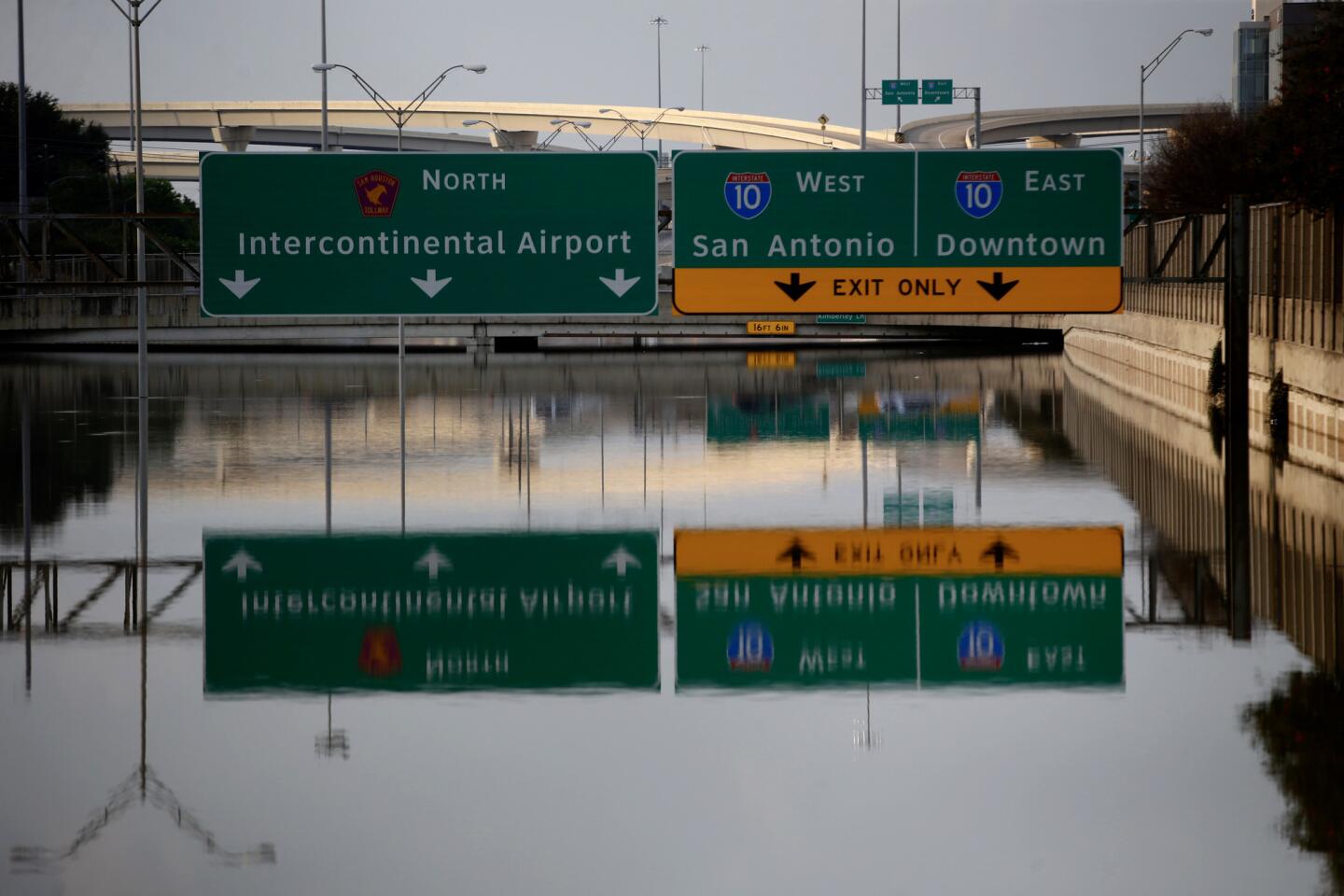

Many roads and Interstates in Texas remain flooded, including this one in west Houston. (Robert Gauthier / Los Angeles Times)

15/87

Jenna Fountain and her father Kevin carry a bucket down Regency Drive to try to recover items from their flooded home in Port Arthur, Texas on Thursday.

(Emily Kask / AFP / Getty Images) 16/87

Lillie Roberts talks with family members as contractor Jerry Garza begins the process of repairing her Houston home on Friday.

(Scott Olson / Getty Images) 17/87

Volunteers from the Ahmadiyya Muslim Youth Association to perform holy prayer as they help local residents in the Kashmere Gardens area of Houston clean out their flooded homes.

(Marcus Yam / Los Angeles Times) 18/87

Volunteers assist Cornell Beasley with repairs to his damaged home in Houston on Friday.

(Scott Olson / Getty Images) 19/87

Katie Estridge organizes hundreds of soaked family photographs on the front lawn of her father’s home in northeast Houston.

(Robert Gauthier / Los Angeles Times) 20/87

Wes Higgins wipes sweat from his face after spending five days patrolling flooded Houston neighborhoods in his boat. Higgins, from Knott, Texas, organized a volunteer team of 10 boats to help Houston residents.

(Robert Gauthier / Los Angeles Times) 21/87

Members of the California Air National Guard 129th Rescue Wing, Senior Airman George McKenzie, left, and Master Sgt. Adam Vanhaaster, right, help a man carry his infant, who has a serious medical condition, to a hospital in Orange, Texas.

(Marcus Yam / Los Angeles Times) 22/87

A search-and-rescue crew speeds along Maple Rock Drive in west Houston looking for flood victims.

(Robert Gauthier / Los Angeles Times) 23/87

A woman and a child are among those rescued by California Air National Guardsmen in Lumberton, north of Beaumont.

(Marcus Yam / Los Angeles Times) 24/87

California Air National Guard 129th Rescue Wing’s Master Sgt. Adam Vanhaaster searches for people in need of help near Lumberton.

(Marcus Yam / Los Angeles Times) 25/87

A man prepares his dinner at home near Lumberton.

(Marcus Yam / Los Angeles Times) 26/87

Boys sit on a damaged railroad track near Lumberton.

(Marcus Yam / Los Angeles Times) 27/87

A woman waves to a California Air National Guard helicopter from her neighborhood near Lumberton.

(Marcus Yam / Los Angeles Times) 28/87

A drop-off point for boat rescues in Lumberton.

(Marcus Yam / Los Angeles Times) 29/87

Baseball fields in Lumberton are inundated.

(Marcus Yam / Los Angeles Times) 30/87

Coca-Cola delivery trucks are trapped by floodwater in Lumberton, Texas.

(Marcus Yam / Los Angeles Times) 31/87

A military search and rescue helicopter refuels mid-flight before resuming nighttime missions over areas flooded in the aftermath of Tropical Storm Harvey.

(Marcus Yam / Los Angeles Times) 32/87

Houston police search a flooded home after hearing that an elderly couple lived there. The house was empty. Police later learned the couple had safely evacuated.

(Robert Gauthier / Los Angeles Times) 33/87

West Houston resident Pedro Albiso uses trash bags to protect his shoes and pants as he prepares to cross a flooded street.

(Robert Gauthier / Los Angeles Times) 34/87

Patients are evacuated from Baptist Hospitals of Southeast Texas after the city of Beaumont lost its water supply.

(Marcus Yam / Los Angeles Times) 35/87

Fatima Flores, 12, gets her hair done by cousins Shelly Flores, 7, left, and Ashley Flores, 7, as their family takes shelter at Max Bowl, a bowling alley in Port Arthur, Texas.

(Marcus Yam / Los Angeles Times) 36/87

James Benoit, left, and George Clipton sought refuge at Max Bowl in Port Arthur, Texas.

(Marcus Yam / Los Angeles Times) 37/87

June Ayrow spent the night with his oxygen tanks underneath a table at Max Bowl in Port Arthur, Texas.

(Marcus Yam / Los Angeles Times) 38/87

Floodwaters surround homes Thursday in Port Arthur, Texas.

(Gerald Herbert / Associated Press) 39/87

Volunteers rescue patients from the Cypress Glen nursing home where floodwaters trapped dozens of elderly patients in Port Arthur, Texas on Wednesday.

(Marcus Yam / Los Angeles Times) 40/87

Residents lie on sofas as they wait to be evacuated from the Cypress Glen senior care facility in Port Arthur, Texas, which was inundated with floodwaters from Tropical Storm Harvey on Wednesday.

(Matt Pearce / Los Angeles Times) 41/87

Emergency crews help rescue elderly residents from the Golden Years Assisted Living home in Orange, Texas, on Wednesday.

(Gerald Herbert / Associated Press) 42/87

Rescuer workers help a woman from her flooded home n Port Arthur, Texas.

(Joe Raedle / Getty Images) 43/87

Evacuees ride on a truck after they were driven from their homes by the flooding in Port Arthur, Texas.

(Joe Raedle / Getty Images) 44/87

People wait in line to buy groceries at a Food Town during the aftermath of Tropical Storm Harvey.

(Brendan Smialowski / AFP/Getty Images) 45/87

Juan Figueroa removes damaged furniture from his mother’s northeast Houston home where residents begin rebuilding from the devastating effects of the storm.

(Robert Gauthier / Los Angeles Times) 46/87

Rafael Minor, left, and Miguel Ramirez remove the contents from a flooded home in northeast Houston on Wednesday.

(Robert Gauthier / Los Angeles Times) 47/87

A construction crew cleans out a home that was flooded by Tropical Storm Harvey in Spring, Texas.

(Brett Coomer / Associated Press) 48/87

A flooded residential neighborhood near Interstate 10 in Houston, Texas.

(Marcus Yam / Los Angeles Times) 49/87

A flooded residential neighborhood near Interstate 10 in Houston, Texas.

(Marcus Yam / Los Angeles Times) 50/87

People come out to view the flooded areas near their homes in Houston, Texas.

(Marcus Yam / Los Angeles Times) 51/87

CaroLine Kirkpatrick of Salt Lake City, Utah, is evacuated from the Omni Hotel by rescue worker Adam Caballero in Addicks, a suburb of Houston, Texas.

(Robert Gauthier / Los Angeles Times) 52/87

People displaced by flooding fill the shelter at the George R. Brown Convention Center in downtown Houston.

(LM Otero / Associated Press) 53/87

Mark Ocosta and his baby, Aubrey, take shelter at the George R. Brown Convention Center.

(Joe Raedle / Getty Images) 54/87

Frantzy Thenor receives an embrace from a fellow evacuee after he helped her leave from the flooded Omni Hotel, in the Addicks area of Houston, Texas.

(Robert Gauthier / Los Angeles Times) 55/87

Storm clouds over Houston skyline.

(Marcus Yam / Los Angeles Times) 56/87

Recreational vehicles sit on their sides in flood water in Houston, Texas.

(Marcus Yam / Los Angeles Times) 57/87

A woman carries a dog above the rising floodwaters near Addicks Reservoir.

(Robert Gauthier / Los Angeles Times) 58/87

Eduardo Retiz, 21, drives his elevated pickup truck through a flooded street near Addicks Reservoir.

(Robert Gauthier / Los Angeles Times) 59/87

Mike Hoskovec, left, walks to a boat after helping friend Ben Berg, behind, move some photo albums to the second floor of his Nottingham Woods home.

(Robert Gauthier / Los Angeles Times) 60/87

Matthew Koser looks for important papers and heirlooms inside his grandfather’s house after it was flooded by heavy rains.

(Erich Schlegel / Getty Images) 61/87

Residents wade through floodwaters as they evacuate their homes near the Addicks Reservoir Tuesday.

(David J. Phillip / Associated Press) 62/87

Larry Koser Jr., left and his son Matthew look for important papers and heirlooms inside Larry Koser Sr.’s house after it was flooded by heavy rains.

(Erich Schlegel / Getty Images) 63/87

Portions of Interstate 10 remain flooded in Houston, Texas.

(Marcus Yam / Los Angeles Times) 64/87

Rising flood waters stranded hundreds of residents of Twin Oaks Village in Clodine.

(Robert Gauthier / Los Angeles Times) 65/87

Comfort Morgan is helped to dry land after being rescued from her flooded home in Twin Oaks Village in Clodine.

(Robert Gauthier / Los Angeles Times) 66/87

Rising flood waters stranded hundreds of residents of Twin Oaks Village in Clodine, where a collection of small boat owners, including some with pool toys, coordinated to bring most to dry ground.

(Robert Gauthier / Los Angeles Times) 67/87

Rising flood waters stranded hundreds of residents of Twin Oaks Village in Clodine, where an collection of small boat owners coordinated to bring most to dry ground.

(Robert Gauthier / Los Angeles Times) 68/87

Hundreds of residents of Twin Oaks Village are evacuated in Clodine Monday.

(Robert Gauthier / Los Angeles Times) 69/87

Residents are stranded at Twin Oaks Village in Clodine due to rising flood water.

(Robert Gauthier / Los Angeles Times) 70/87

Stranded residents of Twin Oaks Village in Clodine are evacuated from the rising flood water.

(Robert Gauthier / Los Angeles Times) 71/87

Jan Tullos, 32, searches a flooded home for an injured woman who was reportedly stranded inside in Clodine, Texas. The home was empty.

(Robert Gauthier / Los Angeles Times) 72/87

People walk down a flooded Houston street as they evacuate their homes after the area was inundated with rains from Tropical Storm Harvey.

(Joe Raedle / Getty Images) 73/87

Dean Mize holds children as he and Jason Legnon use an airboat to rescue people from flooded homes in Houston on Monday.

(Joe Raedle / Getty Images) 74/87

Dean Mize, left and Jason Legnon carry a person to an airboat as they rescue people in Houston.

(Joe Raedle / Getty Images) 75/87

Evacuees walk down a flooded street after leaaving their homes Monday in Houston.

(Joe Raedle / Getty Images) 76/87

Dean Mize holds a child as he helps evacuate people in Houston as Tropical Storm Harvey continues to drench southeastern Texas and Louisiana with heavy rains and surging floodwaters.

(Joe Raedle / Getty Images) 77/87

People evacuate their flooded homes on Monday in Houston. By Monday morning, 911 operators had received 56,000 calls, city officials said.

(Joe Raedle / Getty Images) 78/87

Adults use a kiddie pool to transport children as they evacuate on Monday.

(Joe Raedle / Getty Images) 79/87

People catch a ride on a construction vehicle down a flooded Houston street.

(Joe Raedle / Getty Images) 80/87

Alexendre Jorge evacuates Ethan Colman, 4, from a Houston neighborhood inundated by floodwaters from Tropical Storm Harvey.

(Charlie Riedel / AP) 81/87

People push a stalled pickup to through a flooded street in Houston on Sunday, as Tropical Storm Harvey dumped heavy rains.

(Charlie Riedel / Associated Press) 82/87

A Houston police officer helps Frank Andrews, 74, into his walking chair after rescuing him from his flooded home in the Braeswood Place neighborhood, southwest of Houston, on Sunday.

(Robert Gauthier / Los Angeles Times) 83/87

Wilford Martinez, right, is rescued from his flooded car by Harris County Sheriff’s Department Richard Wagner along Interstate 610 in Houston, Texas.

(David J. Phillip / Associated Press) 84/87

Daniel Gross, 15, is rescued by Houston police after he was stranded on top of his car in southwest Houston.

(Robert Gauthier / Los Angeles Times) 85/87

Andrew White, left, helps a neighbor down a street after rescuing her from her home in his boat in the upscale River Oaks neighborhood after it was inundated with flooding from Tropical Storm Harvey.

(Scott Olson / Getty Images) 86/87

Volunteers and officers from the neighborhood security patrol help rescue residents in Houston’s River Oaks neighborhood Sunday.

(Scott Olson / Getty Images) 87/87

Jesus Nunez carries his daughter Genesis, 6, as he and numerous family members flee their flooded home, walking nearly four hours to the safety of a relative’s house on Sunday.

(Robert Gauthier / Los Angeles Times) ‚ÄúIn the longer run, it‚Äôs going to be positive,‚ÄĚ said Ben Herzon, a senior economist at Macroeconomic Advisers, referring to an expected ramp-up in economic activity resulting from clean-up and reconstruction efforts. ‚ÄúGoing forward, rebuilding is going to swamp any near-term disruptions in the third quarter,‚ÄĚ he said.

It remains to be seen how long it will be before businesses and workers can get back on their feet. The longer it takes, the bigger the blow to near-term economic growth, in lost wages, sales and consumer spending.

‚ÄúThe situation is not over ‚ÄĒ the rain continues to fall, and floodwaters continue to rise,‚ÄĚ said a report by economists at IHS Market, noting that further damage to the region‚Äôs energy, transportation and port infrastructure would have broader ramifications for the national economy.

Greater Houston is the country’s largest metro exporter with $97.1 billion in shipments in 2015, or 6% of the U.S. total, IHS estimated. And more than 30% of the nation’s refining capacity lies in Harvey’s path.

Based on what’s been happening with wholesale gas prices since Harvey, the national average for unleaded gas will hit $2.60 per gallon compared with $2.47 before the storms, said Ryan Sweet of Moody’s.

‚ÄúPrices could move even higher,‚ÄĚ he said. While there is more cushion in supplies than when Katrina hit, he added, ‚Äúdamage to refineries is a serious risk and could cause gasoline inventories to fall more quickly.‚ÄĚ

Harvey swept through a large swath of southeast Texas ‚ÄĒ at least 19 counties have been declared major disaster areas by the federal government. More than 32,000 people have been housed in shelters, and the Federal Emergency Management Agency is expecting nearly a half million people to seek some sort of disaster aid.

Moody’s estimated that as many as 700,000 vehicles and 400,000 homes were significantly damaged. Most homeowners did not have flood insurance, so their personal spending will be constrained.

‚ÄúMy street flooded four times, and each time it came up close to my house,‚ÄĚ said Patrick Jankowski, an economist at the Greater Houston Partnership. He tracked the rainfall with a measuring device in his backyard: 57 inches of rain over five days. The city normally gets 49 inches in a year.

‚ÄúWe‚Äôve had very little business activity since last Friday.‚Ķ We‚Äôve lost a week‚Äôs worth of economic activity,‚ÄĚ Jankowski said. That would translate to roughly $10 billion, if businesses and spending in Houston had come to a complete standstill. Houston is the nation‚Äôs fourth-largest city with a metropolitan population of about 6.8 million, and it generates roughly $500 billion in economic output.

When Harvey struck, the Houston economy was making a comeback from a slump last year caused by depressed oil prices. While the city has long been the nation’s oil capital, in recent years its economy has diversified, thanks to a booming medical industry and low-tax, low-cost climate that has made Houston a magnet for residents and businesses.

The way Jankowski often gauged economic activity was to visit a parking lot in a retail complex with an Ikea store, and he would count the number of out-of-state license plates, many of them from California and New York.

In the wake of Harvey, Jankowski figures the migration into Houston and the surrounding region will pretty much come to a halt in the near term.

‚ÄúThere‚Äôs not much housing for people,‚ÄĚ he said. ‚ÄúNow, unfortunately, most of the out-of-state plates will be construction vehicles.‚ÄĚ

[email protected]

Follow me at @dleelatimes

ALSO

After storm’s fury, a sorrowful task: Gathering up the dead

How a Texas bowling alley became a beacon of hope after Harvey’s deluge

Houston offers a grim vision of Los Angeles after catastrophic earthquake